In a circular issued to heads of all authorised foreign exchange dealers, the SBP said that the new mechanism would be available for payments for goods and services traded between Pakistan and Iran.

Business delegation leaves for Morocco

The transactions eligible for settlement under this mechanism will be denominated in the euro or Japanese yen and based only on documentary Letters of Credit (LCs) conforming to the Uniform Customs and Practice for Documentary Credits 600 published by the International Chamber of Commerce (ICC).

Payments for importers

According to the mechanism, an importer’s bank in Pakistan will credit foreign exchange (ie the amount due under the LC) in the Nostro account of the SBP for onward payment to the exporter in Iran and inform the same to the SBP.

On confirmation of the receipt of funds in the Nostro account, the SBP will ask Bank Markazi Jomhouri Islami Iran (BMJII) to pay the exporter’s bank for onward payment to the exporter in Iran.

Receipts against exports

On receiving payment instructions from an importer’s bank in Iran, BMJII will ask the SBP to make payment in Pakistan. The SBP, on receiving the requests from BMJII, will credit the Nostro account of an exporter’s bank in Pakistan in foreign currency (FCY).

Participating banks will ensure that the transactions conducted under this mechanism are not proscribed and do not involve individuals/entities proscribed under international sanctions.

The execution of transactions will be subject to compliance with all applicable foreign exchange rules and regulations.

According to the circular, authorised dealers, interested to work under this mechanism, should send their written consent to the director, Domestic Markets and Monetary Management Department of the SBP, Karachi by May 31, 2017.

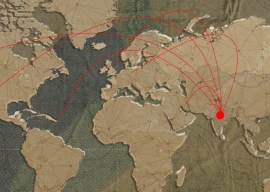

Central banks of Pakistan and Iran signed an agreement last month to establish a trade settlement mechanism. The two neighbours have been trying to increase bilateral trade since Iran and world powers implemented an agreement on Tehran’s nuclear programme in January 2016.

China catalyst for Pakistan's uplift: Shehbaz

However, unlike Iran’s other trade partners, Pakistan failed to take early trade benefits of the agreement because of the absence of proper banking channels between the two countries.

Published in The Express Tribune, May 10th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ