But the ride was volatile, to say the least.

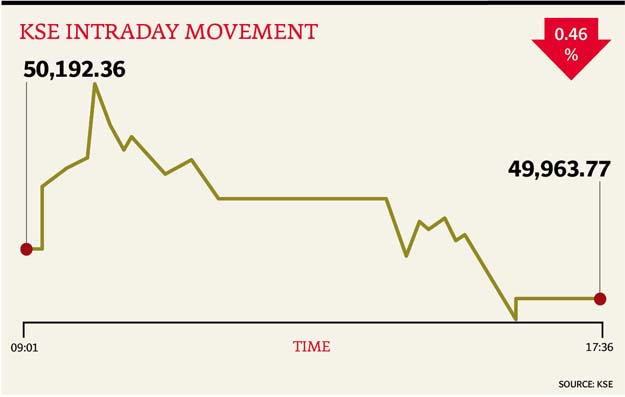

After opening positive and nearing 50,900 with a near 700-point gain, the market came under selling pressure with across-the-board selling to eventually finish below the 50,000-point level.

At close, the Pakistan Stock Exchange’s (PSX) benchmark index ended with a fall of 0.46%, or 228.59 points, to end the day’s trading at 49,963.77.

Elixir Securities analyst Ali Raza said equities closed lower after a highly volatile trading session where the benchmark KSE100 Index traded in a wide range of near 1,000 points.

“The session started to on a positive note as index names across major sectors carried momentum from previous day and pushed KSE100 Index to a new record high near 50,900 level,” said Raza. “Thereafter, the wider market witnessed a spell of profit-taking and extreme volatility that resulted in KSE100 index erasing all gains to enter the red zone and testing support below 49k by closing.

“Trading activity witnessed a hefty surge as over 380 million shares exchanged hands on KSE100 Index, being highest in almost ten years (most since June 2007).

“Strikingly almost 43% of the contribution came from a single stock K-Electric (KEL) that gained +4.1% to settle at a new record close on continued local buying.

“Attock Cement (-3%) and Pakistan Oilfields (-2.9%) closed lower as investors resorted to booking profits after their results came in line with consensus,” said Raza.

“Attock Refinery (-3.9%) and National Refinery (-5%) were down on sub-par earnings; and Attock Petroleum (-5%) closed at lower price limit after company announced a cash payout much lower than expectations.”

Trading volumes rose to 597 million shares compared with Thursday’s tally of 449 million.

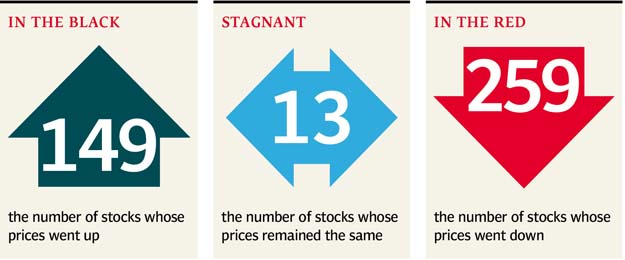

Shares of 421 companies were traded. At the end of the day, 149 stocks closed higher, 259 declined while 13 remained unchanged. The value of shares traded during the day was Rs28.6 billion.

KEL was the volume leader with 165 million shares, gaining Rs0.42 to finish at Rs10.67. It was followed by Faysal Bank with 39 million shares, losing Rs1.30 to close at Rs25.98 and TRG Pakistan Limited with 29.6 million shares, gaining Rs2.02 to close at Rs57.33.

Foreign institutional investors were net buyers of Rs195 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, January 28th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ