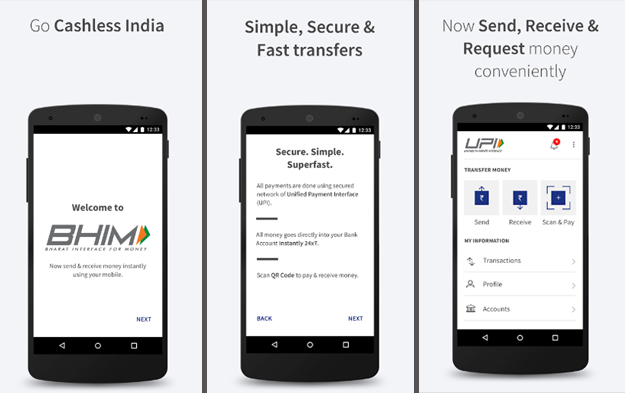

The Android-only app uses the Unified Payments Interface (UPI) launched in April to simplify money transfer between banks. The UPI does away with cumbersome entries like account number, IFSC code, and beneficiary details for digital payments. Instead, a virtual payments address (VPA) – like yourname@upi – can be assigned to every user, which is associated with a unique number and bank account details in the backend. A payment can be sent to or received from a virtual address.

A number of banks have come up with UPI-based apps enabling quick money transfers across multiple banks. But adoption has been slow as they’re overloaded with features and aren’t user-friendly. BHIM aims to fix that by providing the government organization’s alternative to the banking apps.

The demonetisation crisis

It’s an app with the bare minimum functionality required for sending and receiving money, saving the user profile and beneficiary details. The government hopes it will encourage more people to start using it.

Indian customers queue inside a bank to deposit and exchange 500 and 1000 rupee notes in Guwahati, the capital city of the north-eastern state of Assam on December 30, 2016. PHOTO: AFP

Indian customers queue inside a bank to deposit and exchange 500 and 1000 rupee notes in Guwahati, the capital city of the north-eastern state of Assam on December 30, 2016. PHOTO: AFPSince November 8, when India took drastic measures to go cashless, the number of daily transactions on the UPI platform has climbed to 70,000. That’s a minuscule number in a population of 1.3 billion.

Download BHIM (Bharat Interface for Money) App. It will improve ease, experience & efficiency of digital transfers. https://t.co/vTFd5B4aHW

— Narendra Modi (@narendramodi) December 30, 2016

Compare that to the 7 million daily transactions on popular digital wallet Paytm, which will also have a UPI-based app once it gets the final nod to launch its payments bank – a special kind of bank introduced in India which can only handle payments and can’t offer loans. A tech startup may be better placed than a government to make an app user-friendly and evangelize its adoption.

Until then, we have the bank apps and BHIM.

This article originally appeared on Tech in Asia

1732354127-0/Untitled-design-(3)1732354127-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ