As a judicial solution to the political stalemate was agreed upon by the major opposition party, avoiding a standoff in the capital, the index reached an all-time high of 41,974 points easing the pressure from the week before. Mild profit-booking took the shine off the index as it powered towards the 42,000-point barrier on the last day of the week.

However, Monday onwards saw a steady climb of the bourse as political dust settled and banking scripts took centre stage. Friday saw a slight dip as exploration and production (E&Ps) pulled the benchmark index in negative as investors tracked declines in global crude.

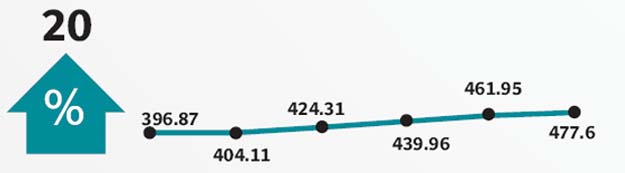

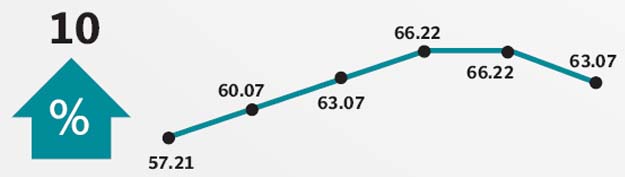

All major sectors remained in the gainer list compared to last week. Top three gainers over the outgoing week were refinery, auto assemblers and oil & gas marketing companies, up 10.5%, 10.5% and 7.7%, respectively.

Commercial banks remained in the limelight, adding 393 points as the stronger than consensus reading (+4.24 points) reaffirmed the view of an interest rate upcycle in the offing that would relieve pressure off NIMs.

Lucky Cement and Pakistan Petroleum Limited cumulatively contributed 161.7 points recovering on the back of value hunting. Other than that, Millat Tractors Limited contributed 63 points (+22% return in the week) to the benchmark index due on anticipation of an upsurge in local and export volumes.

On the other hand, sectors such as fertiliser (+3% week-on-week) underperformed while most of the rally was led by foreign investors and local mutual funds where large buying of $21 million and $28 million, respectively, was observed by the two groups during the week.

Index activity also remained charged up with the news that China’s Shanghai Electric is to buy a $1.77 billion stake in K-Electric Limited. News of the first Chinese shipment reaching Sost dry port in Gilgit-Baltistan also helped fuel activity at the bourse.

News of car maker Renault entering the market sparked interest in auto stocks.

Both average traded volumes up by +42% week-on-week to 484 million shares and average traded value up by 41% week-on-week to $155 million increased during the week.

Winners of the week

Millat Tractors

Millat Tractors Limited assembles and manufactures tractors, implements and equipments.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

International Steels Limited

International Steels Limited manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

Losers of the week

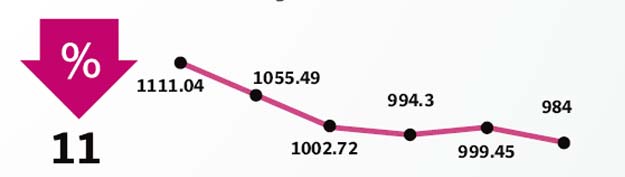

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Its glass division manufactures all the group’s bottles and jars.

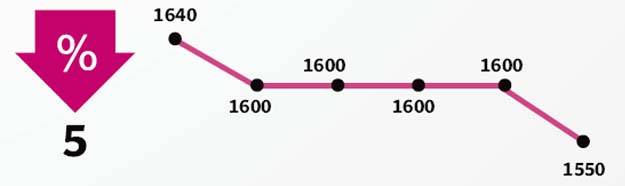

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Published in The Express Tribune, November 6th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1718870162-0/BeFunky-collage-(60)1718870162-0-405x300.webp)

1730504285-0/Martha-(1)1730504285-0-165x106.webp)

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ