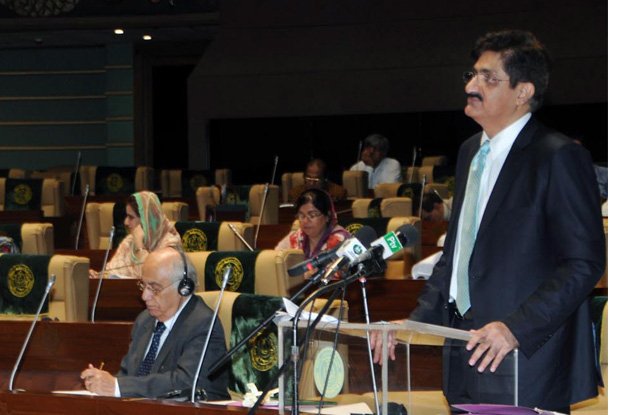

Heaping praise on the three major provincial tax-collecting agencies for their “exceptional” performance, Shah said the growth rate of Sindh’s tax collection over the last three years is higher than those achieved by federal and other provincial governments.

Sindh govt presents Rs869 billion budget

However, he conveniently ignored one fact: the share of direct taxes in the total provincial tax receipts is less than 7%. Direct taxes amounted to just Rs7.7 billion out of the revised estimate of the provincial tax receipts of Rs125.2 billion for 2015-16.

In simple words, the Sindh government has grown its much-touted tax receipts mainly by collecting indirect taxes, which are regressive in nature and imposed on goods and services rather than on income or profits.

Breakdown

There are four main contributors to Sindh’s total general revenue receipts, namely tax receipts, non-tax revenue, federal/straight transfers and “other grants from the federal government”.

Budget documents show that tax and non-tax receipts are estimated to contribute only 22.8% of the total general revenue receipts amounting to Rs727.1 billion for 2016-17. This means the Sindh government finds itself largely dependent on federal transfers and grants that constitute more than 77% of the total general revenue receipts for the next fiscal year.

Non-tax revenues are expected to be Rs12 billion in 2016-17 as opposed to tax receipts amounting to Rs154 billion, budget documents show.

The failure of the provincial government to expand the scope of direct taxes in Sindh has a direct connection with its unwillingness to tax agriculture income. A mainstay of the provincial economy, the agriculture sector is expected to generate only Rs650 million in taxes in 2016-17. This amount is only 6% of total direct taxes that Sindh is expected to generate in the next fiscal year. The tax on agriculture income will be just 0.4% of the total direct and indirect provincial tax collection in 2016-17.

According to the revised budget estimate, the tax on agriculture income will equal just Rs350 million in 2015-16. This is considerably lower than the non-tax receipts of Rs559 million that the Sindh government is expecting to receive in the same year through fees drawn by the government’s educational institutes, including secondary and intermediate schools, technical colleges and universities.

Furthermore, the estimates of expenditures reveal that the government is expected to give agriculture subsidies, which exclude administration expenses, amounting to a staggering Rs8.7 billion in 2015-16, up 106% from 2014-15.

With heavy subsidies and near absence of taxation on the agriculture income, no wonder the provincial government is going to rely on indirect taxation by means of sales tax on services (Rs78 billion), provincial excise tax (Rs4.8 billion), stamps duty (Rs9.5 billion) and motor vehicle taxes (Rs6 billion) in 2016-17.

New tax measures

Shah said the standard rate of the Sindh sales tax will be reduced from 14% to 13% for 2016-17. He also announced the imposition of sales tax on chartered flights services, consultancy services, public relation services, visa processing services, debt collection services and supply chain management services. Currently, businesses having an annual turnover of up to Rs3.6 million are exempted from sales tax on certain services.

With focus on private investors, Rs6.35b earmarked for energy

Shah proposed a 10% increase in this exemption threshold, which means enterprises having an annual turnover of Rs4 million will be exempted from the levy of sales tax.

The finance minister also proposed that the scope of exemption on internet and broadband services used by households, students and researchers be increased. The exemption threshold on internet services will be enlarged from two mbps speed and Rs1,500 per month per user to four mbps and Rs2,500 per month per user, he said.

Published in The Express Tribune, June 12th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713862885-0/Untitled-design-(11)1713862885-0-270x192.webp)

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ