Undeterred by falling oil prices, investors continued to show interest in the index-heavy exploration and production sector with cement and financial continuing to attract. Rupee strengthened for the second successive day, adding to the positive sentiment at the bourse.

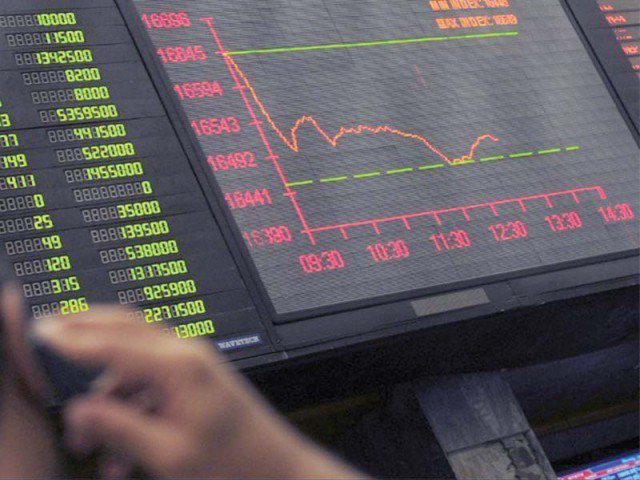

At close on Wednesday, the Karachi Stock Exchange’s (KSE) benchmark 100-share index recorded a rise of 0.70% or 228.55 points to end at 33,020.26.

Elixir securities, in its report, said equities resumed northbound ride on healthy turnover led by cement and financial stocks that gained on the back of institutional buying. “Stocks opened higher as recent sharp recovery in rupee helped sentiment with index managing a close above 33,000,” said the report.

“Undeterred by volatile global crude prices, institutions - local and reportedly foreign - cherry picked index heavy exploration and production shares.

“Oil and Gas Development Company (+1.1%) and Pakistan Petroleum Limited (+0.1%) both ended the day green, while Mari Petroleum closed third consecutive positive day, with its stock gaining nearly 16% since news broke over the weekend of incremental production coming online in months ahead at favourable pricing.

“On-system crosses reportedly by foreign institutions kept financials in limelight with MCB Bank (+1.4%) and Habib Bank Limited (+1.3%) cumulatively adding near 60 points to KSE-100 index.”

Meanwhile, JS Global analyst Arhum Ghous said the market rallied on the back of positive sentiment emanating from improved prospects of improving ties with India.

“Pak rupee’s recent gains of over 2% versus the dollar also added to the bullish sentiment.”

Trade volumes rose to 195 million shares compared with Tuesday’s tally of 192 million.

Shares of 350 companies were traded on Wednesday. At the end of the day, 206 stocks closed higher, 123 declined and 21 remained unchanged. The value of shares traded during the day was Rs10.6 billion.

Silkbank Limited was the volume leader with 23 million shares, gaining Rs0.09 to finish at Rs1.95. It was followed by Sui Southern Gas with 21.2 million shares, gaining Rs1.68 to close at Rs43.48 and Jahangir Siddiqui and Company with 14.4 million shares, gaining Rs0.06 to close at Rs19.56.

Foreign institutional investors were net buyers of Rs22 million worth of shares during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 10th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1719053250-0/BeFunky-collage-(5)1719053250-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ