KARACHI:

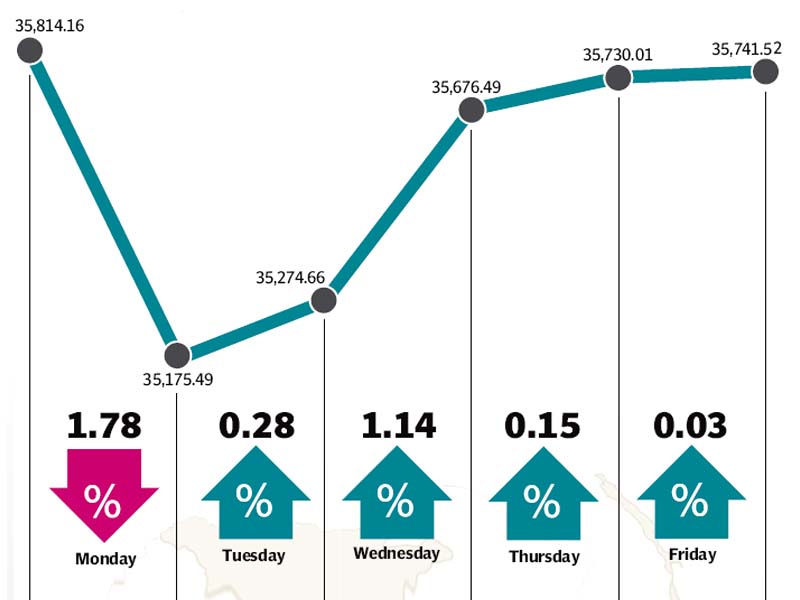

The stock market witnessed an uneventful week, despite the results season kicking into gear, as the benchmark KSE-100 index closed marginally lower by 73 points (0.2%) during the week ended July 31.

The absence of any meaningful triggers reflected on the market as volumes took a plunge. The KSE-100 index witnessed high volatility, only to settle at almost the same level where it ended the previous week.The monetary policy announcement, disappointing earnings for the fertiliser sector and lower cement sales were the major setbacks for the bourse, while a recovery for the oil sector and continued strength of the banking sector were enough for the index to make up for lost ground.

The week started on a negative note as the index dipped sharply by 640 points on the back of future rollovers and resumption of the heavy decline in the Chinese stock market. The State Bank of Pakistan’s decision to keep the discount rate unchanged did not help matters as some market participants had expected a rate cut in the announcement.

The KSE-100 index posted a slow but steady recovery over the next three days as the oil sector started to post gains. The index managed to make up its losses and ended the week at the 35,741 points at the end of trading on Friday.

The start of the results season failed to make any meaningful impact on the market as results were a mixed bag during the week. The announcement of quarterly earnings by Fauji Fertilizers and its subsidiary FFBL led to profit-taking in the fertiliser sector which knocked off 73 points from the KSE-100 index.

On the other hand, Pakistan Oilfields Limited announced that it would reveal its full year earnings on August 13 which sparked a rally in the oil sector despite global crude oil prices sustaining low levels. Investors anticipate that the oil companies will announce strong payouts along with the results.

The cement sector came under pressure after July sales came in lower by 11% on a year-on-year basis due to the Ramazan effect and the onslaught of monsoon rains in the country. The sector was down 2.5% over the previous week and contributed 88 points to the KSE-100’s decline during the week. Foreign flows again changed direction as foreigners were net buyers of $3 million worth of equity during the week as opposed to the $7.9 million net selling in the previous week. With the situation in China still unclear, foreigners have chosen to be cautious about their investments in the region.

Average daily volumes dropped sharply by 39% and stood at 402.7 million shares traded per day, while average daily values also fell 21% to Rs12.8 billion per day. The Karachi Stock Exchange’s market capitalisation stood Rs7.70 trillion ($75.2 billion) at the end of the week.

Winners of the week

Attock Refinery

The Attock Refinery Limited is the pioneer in crude oil refining in the country with its operations dating back to the early 1900s.

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Jubilee Life Insurance

Jubilee Life Insurance Company limited is a general insurance company which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Losers of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Rafhan Maize

Rafhan Maize Products Company limited produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Jahangir Siddiqui & Company

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, August 2nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ