One question that has kept policymakers worried since the sharp fall in global oil prices kicked in is about remittances. Will the money sent by Pakistanis working in oil-rich Arab countries dwindle, as their governments begin to scale back infrastructure spending in the wake of decreased oil prices?

After all, Pakistan’s working migrant population in the Gulf works mostly in construction, manufacturing and other professional sectors, according to the State Bank of Pakistan (SBP).

Any major fallout of the oil price slump on remittance inflows will be detrimental for the national economy. Absent remittances, a perennial balance of payment crisis would be inescapable, as they cover up usually around 90% of the country’s trade deficit.

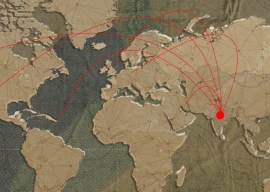

Pakistanis working in Saudi Arabia, the world’s biggest oil-exporting country, had the largest share (30.6%) in the total remittances of $16.6 billion that the country received in July-May. Pakistani workers in Saudi Arabia sent home over $5 billion in the first 11 months of the fiscal year, which is 19.6% higher than the last year’s figure.

Read: Balance of trade: Oil price fall helps imports; exports remain disappointing

The second largest share in Pakistan’s remittances in the current fiscal year so far is of the United Arab Emirates (22.7%) – another country of the Gulf Cooperation Council (GCC). With remittances amounting to $3.7 billion, the year-on-year increase in the net inflows from the UAE was 34.4% – the highest annual rise among all countries during the first 11 months of 2014-15.

After accounting for the inflows from Qatar, Oman, Kuwait and Bahrain, the combined share of the GCC countries in the total remittances Pakistan has received in July-May clocks up at 65%.

Understandably, any cuts in the infrastructure spending in the wake of the global oil price slump will result in job losses for the migrant population working in the construction sector of the GCC countries.

Researchers at the SBP believe the GCC countries are sticking to their infrastructure spending plans for the time being. “The good news is that despite the oil slump, the GCC is still spending on infrastructure … there are no short-term concerns for remittances inflows into Pakistan from this region,” the SBP said in its second quarterly report last month.

However, its optimism came with a note of caution. Saying that the GCC governments’ spending plans have not been affected by declining oil prices due to the large sovereign funds, the SBP noted the status quo may not continue ‘much longer’.

“A continuous depletion of these reserves would eventually start biting into their fiscal spending if oil prices fail to recover. The pace of Pakistan’s remittance growth cannot remain immune to the oil slump indefinitely,” the SBP said.

Not on a par with India

Official statistics show the amount of remittances overseas Pakistanis send home annually is less than the money Non-Resident Indians (NRIs) send to their country every year. This is true for not only the Gulf region, but also the rest of the countries where Pakistanis are employed as immigrant workers.

For example, an average NRI sent home $4,896 in 2013. This is roughly double the amount that an average Pakistani working overseas sent home in the same year ($2,465).

Similarly, the gap in the average size of annual remittances from Indian and Pakistani expatriates in Saudi Arabia is almost the same. The average NRI in Saudi Arabia sent home $4,757 in 2013, which is more than twice the amount sent home by his Pakistani counterpart ($2,248).

Read: Six months: Country exports crude oil worth $157m

The average NRI working in the UAE sent home $5,499 in remittances in 2013, which are over three times the comparable remittances sent by the average Pakistani worker in the oil-rich country ($1,790). The reason, according to the SBP, is that unskilled labour finds work ‘more easily’ in the UAE, although there has been an improvement in the skillset of Pakistani workers of late.

The writer is a staff correspondent

Published in The Express Tribune, June 22nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (6)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ