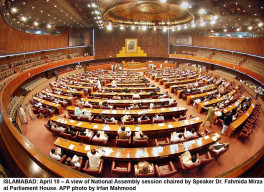

ISLAMABAD: Local industrialists, in a meeting at the Islamabad Chamber of Commerce and Industry (ICCI), strongly protested against the passage of the Gas Infrastructure Development Cess (GIDC) bill from the Parliament and called upon the government to urgently withdraw it.

According to them, it will increase the cost of doing business, make the export sector unviable in the global market and cause closure of large number of industrial units in the country rendering thousands of workers jobless.

ICCI President Muzzamil Hussain Sabri said that businessmen have been expressing great concerns against the GIDC ever since its introduction through the GIDC Act in 2011 while the top court of the country had also termed it illegal and had ordered for refund of the amount collected to consumers.

But it was highly unfortunate that the government totally ignored the concerns of the business community against this levy and went ahead with its plan to give it legal cover.

He said that government’s intransigent stand on the GIDC in spite of protests and the Supreme Court’s rejection of its review petition has been received with disappointment and this measure will also give rise to inflation, putting more burdens on the common man.

Abdul Rauf Alam, the group leader, said that the government had claimed to utilise the funds raised through GIDC for developing the infrastructure of the IP and TAPI gas pipeline projects and projected collection of Rs145 billion during the current financial year, while it has so far collected only Rs99 billion through this tax.

He added that it was totally unjustified to start an advanced collection of cess for work that has not been initiated yet. The $4.8 per mmbtu gas tariff for industries in Pakistan, compared to India ($4.66), Bangladesh ($1.86) and Sri Lanka ($3.66), was already the highest in the region, adding that the GIDC would take it up to $6.27.

“This would render our industry extremely uncompetitive and severely damage growth,” he said.

The industrialists said that the best option for enhancing tax revenue was to promote industrialisation in the country by creating an investor-friendly environment.

Published in The Express Tribune, May 22nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ