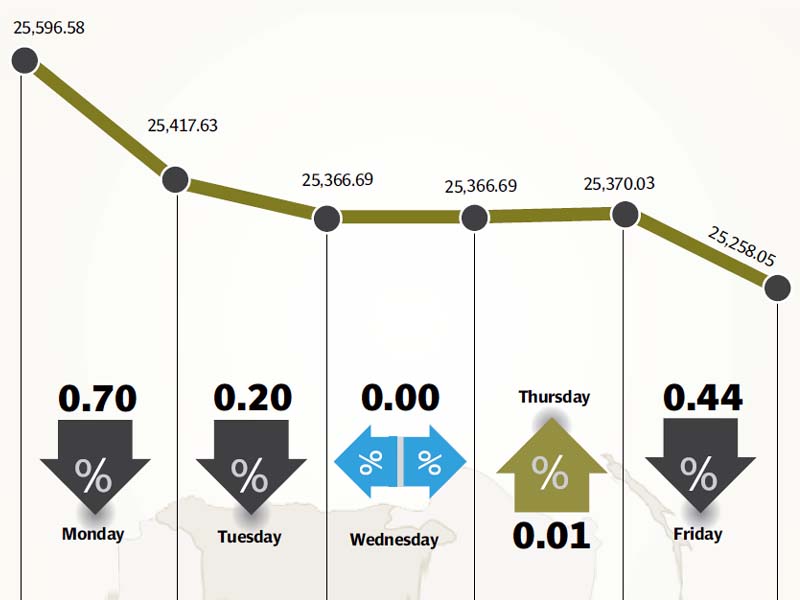

The stock market shed 321 points or 1.3% in the week ended December 27 amid sluggish activity and lack of foreign interest because of Christmas and New Year, resulting in reduced volumes.

Major drivers during the week were the news that the United States was linking reimbursements under the Coalition Support Fund to ending of blockade of Nato supply routes, and current account numbers, showing a higher deficit in November. The gap was $589 million compared to $96m in the previous month.

The textile sector was hit by reports that Walt Disney might bar Pakistan from the list of countries which provided merchandise to the company, but Nishat Mills bucked the trend on the last day of the week, gaining value. The news dampened general euphoria in the sector which had just begun celebrating the approval of the GSP Plus status by the European Union.

Figures from the State Bank of Pakistan (SBP) showed a dip in foreign currency reserves to $3.1 billion, however, the approval of the second International Monetary Fund (IMF) loan tranche, which was not included in the figures, was expected to stabilise the reserves.

The rupee also recorded a steady appreciation against the dollar after a speech of Finance Minister Ishaq Dar in which he vowed that the currency would fast recoup the losses.

Most analysts still believe that the reversal of trends in the currency market is artificial and short-term, given the large $598m and growing current account deficit, and balance of payments gap of $529m.

The government also released a report on the country’s oil and gas reserves as of June 30 this year, which showed Oil and Gas Development Company and Pakistan Petroleum Limited had registered an increase in their reserves, while Pakistan Oilfields Limited saw a decline.

In the telecommunications sector, there was news that Zong would get the Long Distance International licence, which would allow the telecom services provider to compete for the existing market share. As a result, the remaining players saw their share prices drop.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

GlaxoSmithKline

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

Losers of the week

Shifa International

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicine, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology. Shifa also provides diagnostic services including specialised diagnostics, radiology and clinical laboratory.

Agard Nine

Azgard Nine Limited manufactures and exports textile products such as denim fabrics, and apparel. The company also manufactures and sells urea and phosphatic fertilisers from its fertiliser plants.

MCB Bank Limited

MCB Bank Ltd is a full-service commercial bank. The bank offers a wide range of financial products and advice for personal and corporate customers, including online banking services.

Published in The Express Tribune, December 29th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ