KARACHI:

The Karachi bourse remained extremely volatile, touching an intraday high of 23,062 points but closed about 400 points down. Selling pressure in global equity and currency markets and the ongoing Syrian crisis induced the sell-off in the country’s largest stock market.

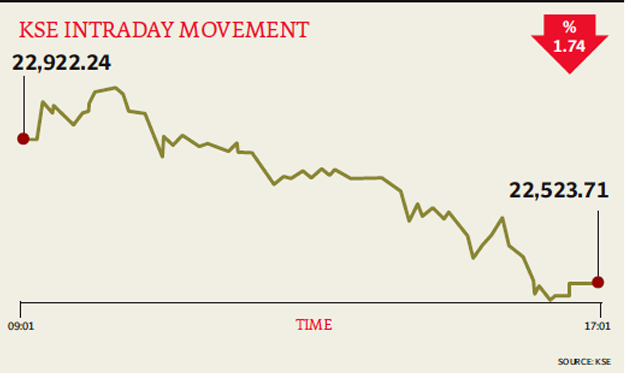

The Karachi Stock Exchange’s (KSE) benchmark 100-share index lost 1.74% percent or 398.53 points to end at the 22,523.71 point level. Trade volumes fell to 188 million shares, compared with Monday’s tally of 202 million shares.

“Equities felt the pain in the region with the benchmark index testing the 22,500-point level on thin volumes. Investors are already cautious and confused and resisted thetemptation to buy at the current level and preferred trimming long positions on fear of foreign selling and concerns over the sinking rupee along with other macro challenges,” reported Faisal Bilwani, analyst at Elixir Securities.

“Bears gained strength as fears of an interest rate hike coupled with the global equity sell-off battered sentiments,” said Samar Iqbal, assistant vice president of equity sales at Topline Securities.

Shares of 353 companies were traded on Tuesday. At the end of the day 70 stocks closed higher, 243 declined while 40 remained unchanged. The value of shares traded during the day was Rs6.86 billion.

Pakistan State Oil, which is due to announce its half-yearly performance today, sparked the fuse and other index-heavy names followed suit. Activity in the broader market remained thin with select local investors active while foreign inflows were also very selective.

Index heavyweights including MCB Bank, Oil and Gas Development Company, Pakistan State Oil and Pakistan Oilfields dived, while Engro Foods and Adamjee Insurance closed at their respective lower locks. Adamjee Insurance’s earnings announcement for the second quarter of 2013 missed street estimates, which also encouraged investors to off-load their positions on the stock.

Bank of Punjab was the volume leader with 23.65 million shares falling Rs0.65 to finish at Rs12.49. It was followed by Lotte Chemical with 10.85 million shares shedding Rs0.21 to close at Rs7.62 and Fauji Cement with 8.46 million shares losing Rs0.46 to close at Rs14.29.

Foreign institutional investors were net sellers of Rs43.5 million, according to data maintained by the National Clearing Company of Pakistan.

Published in The Express Tribune, August 28th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ