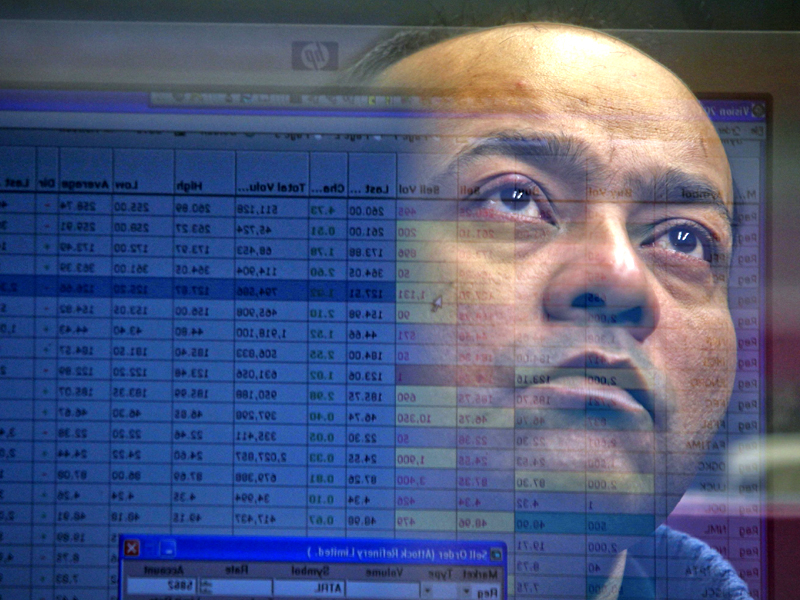

The stock market continued its downward trend for another day as investors rid their portfolios of volatile stocks.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1.31% or 300.95 points to end at 22,714.32 points.

“Selling pressure was witnessed across the board, as NBP (-5.0%) and ENGRO (-3.7%) failed to meet the market’s earnings expectations.” Said Mujtaba Barakzai of JS Global.

“Concerns over a potential hike in discount rate in the upcoming monetary policy also kept investors concerned, particularly in the cement sector.” He added.

The government is set to release its monetary policy on Aug 27, 2013. Investors expect the government to increase discount rates in an effort to meet the pre-requisites set by the International Monetary Fund (IMF) for its assistance program. As a result investors have been avoiding the banking sector which will be hit adversely by the move.

“A depreciating currency ahead of government repayment to IMF worth $480 million persuaded local institutional selling to wipe off earlier gains. National Bank of Pakistan (NBP PA -5%) despite beating market expectations on its half yearly earnings witnessed lower price limit as investors believe the anticipated rate hike has already been priced in.” said Harris Ahmed Batla of Elixir Research.

Batla added that “Reported institutional selling remains evident in oils and cements after flawed rumors of cement price increase, while retail plays continued to churn volumes trading red.”

Trade volumes fell to 217 million shares compared with Wednesday’s tally of 252 million shares.

Shares of 345 companies were traded on Thursday. At the end of the day 85 stocks closed higher, 228 declined while 32 remained unchanged. The value of shares traded during the day was Rs10.2 billion.

Fauji Cement was the volume leader with 22 million shares losing Rs0.26 to finish at Rs14.42. It was followed by Bank of Punjab with 19 million shares gaining Rs0.08 to close at Rs12.59 and National Bank with 13 million shares losing Rs2.7 to close at Rs51.47.

Foreign institutional investors were net sellers of Rs483 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, August 23rd 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ