LAHORE:

Real estate markets are hitting record highs just like the peaks being enjoyed by the stock exchange these days. Prices of land in Punjab’s capital Lahore, a major beneficiary of the property boom, are reaching a point where few experts anticipate a correction, but most of the market players believe that despite all odds a lot of potential is still left.

The real estate boom reminds many investors of the year 2005, when sentiments in both the real estate and stock markets were more or less the same and people were busy making money via both mediums.

At that time, no one seemed to be excessively worried about the future. Economic growth touched 5.82%, job and business opportunities cropped up, banks notched profits and offered loans to even people with low income and the industry flourished.

The Karachi Stock Exchange – the main stock market of the country – vaulted past 10,000 points and reached 10,300 in March 2005 and real estate prices in Defence Housing Authority (DHA) topped Rs15 million for a one-kanal plot. This was the time when suddenly the KSE crashed, plunging 2,400 points in just a week and sent small and medium-sized investors, who saw their investments worth billions of rupees disappear in no time, scurrying for a way out.

The crash was not restricted to the KSE alone, it started hurting real estate markets in all major cities in the country. But unlike the KSE slump, the real estate downslide was not rapid.

In the beginning, investors were expecting a slow drop in real estate prices, considering it a correction phase. However, after months of persistent decline, they panicked and started selling their property in haste, leading to an average 50% fall in prices.

Plot prices, which stood at Rs15 million, dropped to around Rs7 million or even lower.

People, who had booked plots and houses at high prices in different housing societies, started defaulting on instalment payments. Banks got stuck as borrowers failed to repay their debts and some of the banks found no other escape route but to merge and some others sold their business.

Over the years from 2005 to 2013, both markets picked up momentum a couple of times, but not of the level which could well be described as a real boom.

Now gross domestic product (GDP) growth is at 3.6% with slower economic activities and fewer job opportunities. The benchmark KSE 100-share index stands at 23,437 points, up 127% from the peak of 2005. Unfortunately, there is no organised structure or office to assess the growth of the real estate market.

However, considering the land prices in 2005 which were around Rs15 million for a plot of one kanal, prices are now up 73%, standing at Rs26 million. In DHA Lahore, prices have shot up 246% from the lowest point hit in 2005 and in Bahria Town prices have soared 700% – one kanal plot in 2005 was around Rs2 million which now costs Rs16 million.

“In economies like Pakistan, we cannot predict anything, but it is the widening demand-supply gap that makes us believe that the future of real estate market is quite promising,” said Rashid Chohan, Managing Director of Chohan Estates, one of the oldest and largest real estate brokers in Lahore.

“Sentiments about our economy are much worse today than in 2005, but if we compare exchange rates of today and 2005 (up 73%), then you will find a slight increase in real estate prices. This should rise further as people have money to invest and urbanisation is at its peak,” he commented.

Published in The Express Tribune, August 17th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1713425884-0/Tribune-Collage-Feature-Images-(10)1713425884-0-270x192.webp)

This balloon of real estate will definitely burst down, but still there is time gap. Since dollar price is rising continuously and general inflation is persistent. the current rise in real estate prices will continue, however it will reverse back as some stage that may take another 6 to 9 months

Well , its now time to get involve in buying/selling of property . I would not recommend long term investment at the moment . People may get good return on short term investment i-e for 2 to 3 months investment . This Real Estate balloon can burst anytime now like it was in 2005 .

@Khurram Awn: I understand your sentiment, but its like that everywhere and that is particularly why we have Home financing. We need to move away from cash economy mindset.

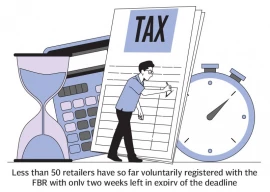

Now who says Pakistan is a poor country?? I urge the govt to TAX the massive buying selling going on in the property as these are the filthy rich people in the real estate game. And to the IMF I would say, you guys should seriously reconsider giving aid to Pakistan.

So this means a person who is even earning One Lakh Rupees per month have to save for more than 20 years to buy a one kanal land in DHA. And then it will took him another 10-15 years to build home on it. Or in other words we could state that Lahore will become a Playground for Rich Only in future.!!!

Lahore's real estate sector boom is the clear example where Politicians and their Sycophant Planners concentrate everything in one city and rapid migration shoot prices to such an extent that even Middle class is expelled from this equation of owning a house.