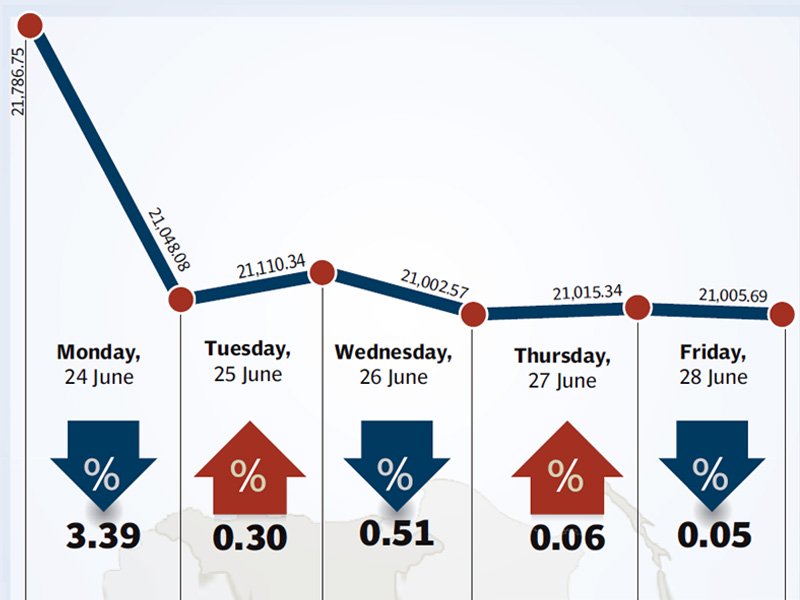

KARACHI: Bears tightened their grip on the country’s largest bourse despite a 50 basis points reduction in the discount rate as the benchmark Karachi Stock Exchange’s 100 share index slid 693 points (3.59%) during the week to close at 21,005 points.

The bulk of the decline came on the opening session of the week, when the index plummeted 650 points and closed marginally above the 21,000-point barrier. The barrier became a support for the rest of the week as the index managed to hover above it despite volatility.

This week’s decline follows up on the massive 3.7% decline witnessed in the previous week, resulting in an overall decline of 1,536 points or 7.9% for the benchmark index in past two weeks.

It was expected that the market’s slide would halt following the announcement of the monetary policy last Friday by the State Bank of Pakistan, where it slashed the discount rate by 50 basis points to 9%.

Further impetus was provided by the announcement of the government’s plan to retire the Rs500-billion worth of circular debt plaguing the country’s power sector. The plan involves payment of Rs326 billion by June 30 and the complete settlement of the circular debt by August 10, based on certain preconditions.

However, the market responded poorly to these developments and continued on its downward route. If the circular debt plan is successfully implemented, companies belonging to the energy sector could receive a significant boost in the coming weeks.

The market’s fall was largely attributed to a correction, with investors booking profits at high levels. Weak foreign interest was also blamed as net foreign buying stood at only $3.7 million as compared to $9.2 million in the previous week. Foreign investment has steadily tapered off in recent weeks.

The volatile political situation also had a hand in the market’s misfortune as the newly-elected Prime Minister Nawaz Sharif announced that he will pursue treason charges against former president General (retd) Pervez Musharraf, which could potentially lead to a confrontation between the government and the country’s powerful army.

The interest rate cut also meant a blow to the banking sector, and it was evident with index heavyweight MCB Bank taking a drubbing and declining 13.7% percent, whilst the entire sector was down 5.7% during the week.

The fertiliser sector was also under pressure as news reports suggested that the feedstock gas prices for the sector will be hiked by Rs218, resulting in an increase in the price of fertiliser bags by Rs250. With international fertiliser prices remaining soft, it can result in a challenging situation for local manufacturers, according to a report by JS Global Capital.

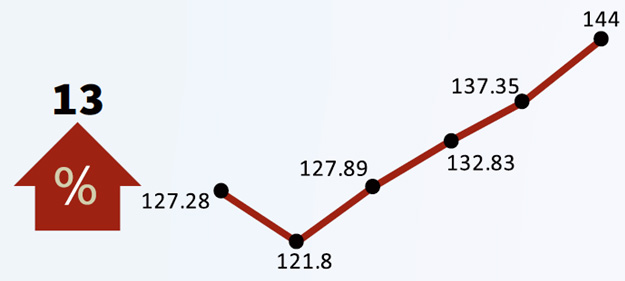

Winners of the week

IGI Insurance Company

International General Insurance Company of Pakistan Limited provides property and casualty insurance products and services. The company’s products include fire, marine, and motor insurance.

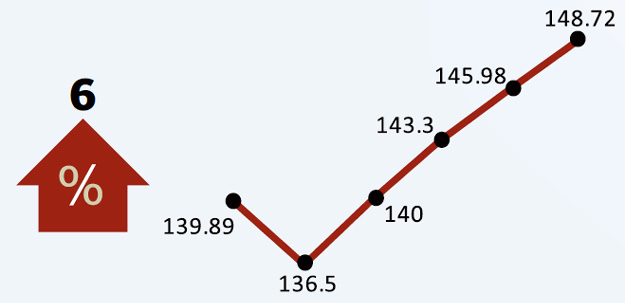

Pakistan International Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Pak Suzuki Motor Company

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

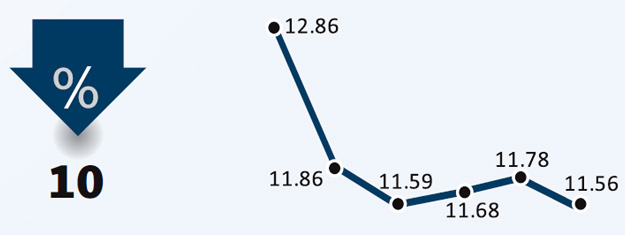

Losers of the week

MCB Bank

MCB Bank is a full-service commercial bank. The bank offers a wide range of financial products and advice for personal and corporate customers, including online banking services.

Pakistan Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company is an investment company offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, June 30th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ