LAHORE:

In the coming year, Punjab will become the first province to have a provincial budget that crossed the trillion-rupee line, with Finance Minister Shujaur Rahman announcing a Rs1.2 trillion budget for fiscal year 2014 on Monday, focused as in previous years on enhancing the province’s core economic strengths in agriculture and infrastructure.

The budget has several common themes carried over from previous years’ budgets as the infrastructure-friendly ruling Pakistan Muslim League Nawaz (PML-N) seeks to build roads, highways, power plants, and irrigation canals in the province. The development budget has been set at Rs290 billion, about 74% higher than last year’s spending numbers, though only about 16% higher than the development budget announced last June. Punjab, like Sindh, has a problem with being able to spend all of the money it allocates, largely owing to the inefficiency of the provincial bureaucracy.

In contrast to the federal budget announced by the PML-N, the provincial budget contained far more populist measures:

there was an increase in the provincial minimum wage from Rs9,000 to Rs10,000 and the government announced several new taxes on the more affluent segments of society.

Taxation and austerity

Given the fact that a large proportion of most wealthy Pakistanis’ net worth is tied up in residential real estate, the provincial government has decided to levy a tax on it.

Residential properties of between two and four kanals (1,210 square yards to 2,420 square yards) will have to pay an annual tax of Rs500,000. Properties of between four kanals and an acre (4,840 square yards) will be required to pay Rs1 million in taxes and residential properties larger than one acre will be required to pay Rs1.5 million in taxes.

Analysts suggest that the vast majority of residential real estate in the province will not be affected by the tax, which appears to be the government’s goal anyway. “Our taxation plans target the rich,” said Punjab Chief Minister Shahbaz Sharif.

The finance minister had similar sentiments. “The Punjab government will not levy any tax on the poor. Only those segments will be brought into the tax-net which can pay taxes,” said Shujaur Rehman.

The provincial government also pledged to implement the Punjab Agricultural Income Tax Act of 1997, though they did not specify how this would be done.

Spending priorities

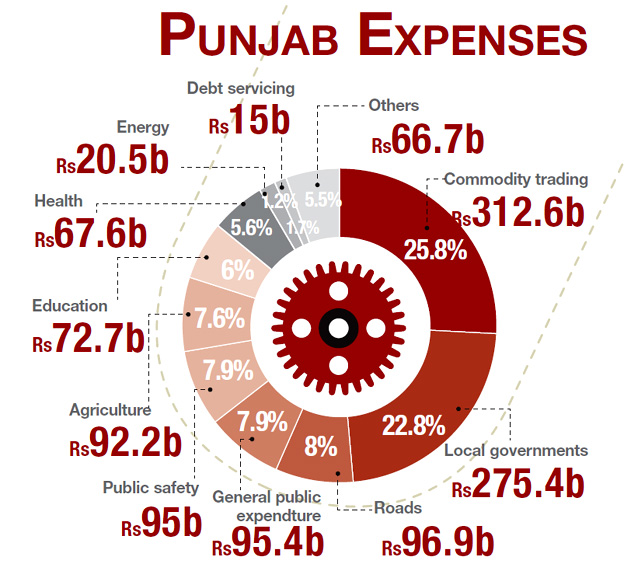

In addition to several populist schemes – including a continuation of the students laptops scheme – the provincial government appears to have largely decided to stick to the formula that worked in their previous term, with only one major exception: the allocation for development projects in the energy sector have been doubled, albeit only to Rs20 billion.

Aside from the massive wheat-buying operation of the provincial government – which is financed through bank borrowing and not taxes – the single biggest expenditure of the Punjab government will be the salaries of local government employees, mostly school teachers and medical professionals working in public health facilities.

The next largest expenditure is on roads and other physical infrastructure, clocking in at Rs97 billion, an increase of over 26% from last year. And in a bid to address the allegation that Lahore monopolises the provincial budget, about Rs10 billion has been earmarked to bring Faisalabad, Multan, Rawalpindi and Gujranwala at par with provincial metropolis.

The provincial government will continue its land record computerisation programme, as a means of trying to secure property rights in a province that is already known to have a relatively stable rule of law. Public safety expenditure in the province is expected to come to about Rs95 billion, up by nearly 12% compared to last year.

The chief minister’s favourite laptop scheme for college students, meanwhile, is expected to cost Rs1 billion. About Rs7.5 billion will be spent trying to run agricultural tube-wells on biogas and solar energy. Another Rs22.5 billion will be spent improving the province’s irrigation system.

Published in The Express Tribune, June 18th, 2013.

COMMENTS (32)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

96.9b for roads and 72.7b for Education. Well done punjab govt :) thats y u were elected we are dying to have roads and illiterate people

The Government of Pakistan‘s Punjab Province has allocated millions of rupees in its budget for fiscal 2013-14 for the largest centre of the Jamaat-ud-Dawah, considered a front for the banned Lashkar-e-Tayyeba. Besides a grant-in-aid of over Rs 61 million for the JuD centre known as ‘Markaz-e-Taiba’, the Provincial Government has allocated Rs 350 million for setting up a ‘Knowledge Park’ at the centre and other development initiatives. One document stated: “Grant-in-aid to chief administrator Muridkey Markaz (is) Rs 61.35 million.” The JuD’s centre is located at Muridkay on the outskirts of Lahore. In his budget speech in the Assembly, Finance Minister Mujtaba Shujaur Rehman announced that the Provincial Government “intends to establish a Knowledge Park in Muridkey”. He said the Government had allocated Rs 350 million for the park and several other initiatives in Punjab. Shortly after the UN Security Council designated the JuD, a front for the LeT in the wake of the 2008 Mumbai attacks, the Punjab Government took over the centre in Muridkey. At that time too, Punjab was ruled by the PML-N. Since then, the Government has allocated money in its annual budget for the administration of the centre in Muridkey. In 2009-10, the Government provided more than Rs 82 million for the administration of JuD facilities.

@Zain: Your stats are right bro, just ensured these figures from the documented data as2 well. Its 238 billlion, instead of what they have mentioned here..

Similarly gas resources resources r generated in baluchistan & sindh, a majore share which is then used to run industries in punjab!

thank you IMRAN KHAN......................

@Mehreen Awan:

Please correct your information. Punjab does not buy wheat for Sindh; we are self sufficient in wheat, rice, sugar cane, cotton, gas, electricity and many other resources. We learned the lesson hard way when PMLN government banned wheat transport to Sindh a year into its last government in 2009.

The only thing Punjab does prepare for Sindh are TTP, LeJ and SSP terrorists which we eagerly hope it will stop producing now that it is in power in the Center.

@Zain: that 230 billion includes the salaries and pensions, including all that KP's budget is 102.5 billion. now compare the population and the amount and the perecentage of the budget.

@SHB: This is addendum to my last comment. Are we talking about male or female widow? There is another angle to this widowhood. There is no active mechanism in Pakistan for transfer of ownership name to wife or husband after one of them dies. Living spouse or children will keep the property in original name for next twenty or thirty yrs or till they decide to sell it. So this loophole of widowhood must not be allowed and no exemption should be given to any body especially this rich segment of the society. Period.

68b for health, 73b for education and 97b for ROADS! Wow!

@Peace: Punjab has alloted Rs. 210 Billions for Education.

http://www.thenews.com.pk/article-105679-Punjab-govt-unveils-Rs-871-billion-budget-

@Peace: These are new allocation aside from current expenses on education which when added takes to educational budget to 210 Billion

Punjab is distributing 275 bn in Local government and allocating only 20bn for energy. They are still not serious about creating their own electricity.And then who they gonna blame? Center govt?

@jibran: You and I are on the same wavelength. We should work together to solve the problems of the Punjabis. We should make connection and see how to move forward.

I can draw a much better pie chart than this! I will be impressed when its implemented and some achievements are shown as the govt. progress!! We have seen their budgets in the past not even 50% spent towards the allocated fields. Remember the new rule; you dont perform you dont get votes.

the figure for education budget is wrong last year it was Rs.195 billion this year it's around Rs 210 billion.

@jibran: You're saviour had already been sent by God in 2008. He's already done all the saving he wanted to in Punjab in the last 5 years. Now lets hope he doesn't try to save the rest of Pakistan.

This is what happends when you have real opposition. Well done pti for getting punjab govt to present a reasonable budget. We must now keep pressure on all provisional govts to deliver on these plans.

@jibran Do you have any idea why we are spending 25 percent of the budget on Commodities because of which we dont have much money for other allocations.?. Educate yourself and then you will be silent that why we have to buy these products with such a major chunk in our budget and for whom.

72.7b for education??? on CM's facebook page its 210b. :S

The Punjab Budget on self occupied houses is a Taxation decoity on middle income. For those who have inherited a house and are subsisting on humble incomes, levying a Rs 10 lakh luxery tax is no less than big time decoity. They want to push us out of our houses and gain control of our property. Is it now not clear that the Muslim League N is nothing but the most ruthless Qabza Mafia in the country?

There should be no exemption for property tax for widows. If these widows own plots two ,four or eight canals, then these properties are worth multi million rupees. These widows can easily pay five or ten lakh rupees as tax. They must be taxed. In USA there is no such exemption. If you own an asset then you must pay the tax. Period . It is that simple

The 72.7 bn allocated for education also include the fund for laptops and solar lamp gimmickery.

Punjab Government takes the lead in Levying tax on luxury mansions & large real estate. It will definitely enable the government to tap hitherto untapped resources by burdening only the rich class and help Pakistan in raising Tax to GDP ratio. other provinces should follow this approach.

One of the things which is commendable in this budget is the Compulsion of Enrollment of 10 Percent Poor kids in Private schools who are charging above 5000 Rs per month and an idea has been given that rather than getting taxes from Schools they will charge no fee from 10 Percent enrolled kids. Now All Beaconhouses, Educators, Army Public colleges, City Schools and American school systems have to enroll 10 percent kids from Poor background. If this system could be implemented in a transparent manner then it will be a good step indeed.

The local government expenditure is almost entirely health and education department employee salaries, as they are devolved on an administrative level to the districts.

Please show a correct pie chart that includes teachers salaries in the education budget (Punjab Teachers Union has more than 350,000 members and their salaries are easily more than 100 Billion).

Education 6%, health 5.6%, energy 1.7%. We, the punjabis, are extremely lucky to have God sent savior in the form of Mian Shahbaz Sharif to resolve all of our problems. No more dengue, no strikes by doctors, excellent services in the hospitals, and of course no load sheddings.

How did this report arrive at the Rs 72.7 Billion figure for education.

I quote from the Budget White Paper:

"Here, it may be worth mentioning that education (like health) is a devolved subject and bulk of the expenditure on education (including expenditure on primary education) is made through transfers to district governments. It may also be highlighted that during next FY 2013-14 total expenditure on education including that of District Governments is estimated to the tune of Rs.230,891.382 million. This includes expenditure on current and development sides both at district and provincial level"

Yes, 230.8 Billion combined current and development (ADP) expenditure. ADP less expenditure on education is a tad above 210 Billion, 3x the 72.7 Billion cited.

KPK 66 billion and Punjab 72.7 billion for Education. Compare the population of the two provinces. Shame on Punjab government.