KARACHI:

The stock market witnessed trading in a narrow range, as investors chose to be cautious ahead of the monetary policy announcement and adopted a wait-and-see approach during the week.

However, the benchmark KSE-100 index still managed to gain 37 points (0.2%) and hit a new all-time high of 16,845 points by the end of the week. Volumes dropped by a whopping 43% to 135 million shares traded per day on average, down from 235 million shares per day during the previous week.

Earlier in the week, news had emerged in several newspapers that the State Bank of Pakistan (SBP) may not cut the interest rate, as earlier expected, due to continuous government borrowing and further clarity on inflation numbers emerged.

Inflation for the month of November was surprisingly recorded at 6.9%, which had provided a boost to the market in the previous week. However, a SBP report also revealed that money supply had grown by 17.8% year-on-year.

Furthermore, it was rumoured that the central bank will hold out till the government clarified inflation figures to the International Monetary Fund (IMF) in January, and then take a decision on the discount rate. The ambiguity led to investors remaining on the sidelines throughout the week.

It was not until the bourse had seen through its final trading session of the week that the central bank finally announced the monetary policy and slashed the interest rate by 50 basis points, to bring it down to 9.5%. This is the first time since July 2007 that the discount rate is in single digits and the rate cut can be expected to provide excitement at the bourse in the coming week.

Several macroeconomic figures emerged during the week, evoking a mixed response from investors. On the positive side, the country’s trade deficit declined 9.9% in the first five months of the current fiscal year. Remittances also stood at an all-time high of $5.98 billion for the period.

On the negative side, the country’s foreign exchange reserves continued to deplete and stood at $13.4 billion as compared to $13.5 billion in the previous week. News also emerged that the government may try to reschedule the IMF payments or even engage in a new IMF programme to facilitate the repayment of the country’s debt.

In sector specific news, the Ministry of Commerce issued a notification for the reduction in the age limit for used cars, which provided a boost to the shares of local car assemblers. The cement sector took a hit, as a transport strike had crippled the supply chain of raw materials. However, this was resolved by the end of the week.

The decline in daily volumes was matched by the decline in average daily values, as only Rs3.64 billion per day were traded at the bourse, a decline of 38%. The market capitalisation of the KSE remained flat at Rs4.22 trillion by the end of the week.

Winners of the week

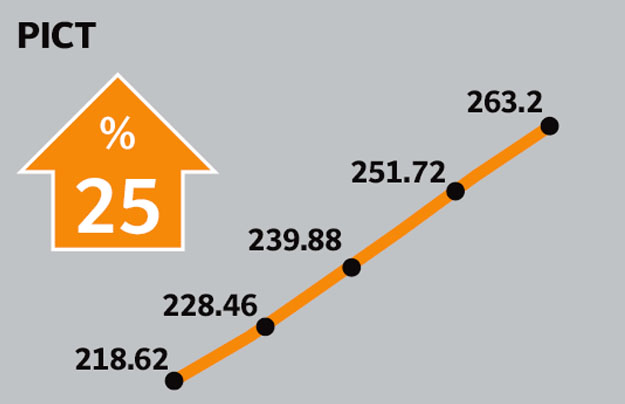

PICT

Pakistan International Container Terminal Limited operates as a terminal operating company in Karachi. It engages in the construction, development, operation, and management of a common user container terminal at Karachi Port.

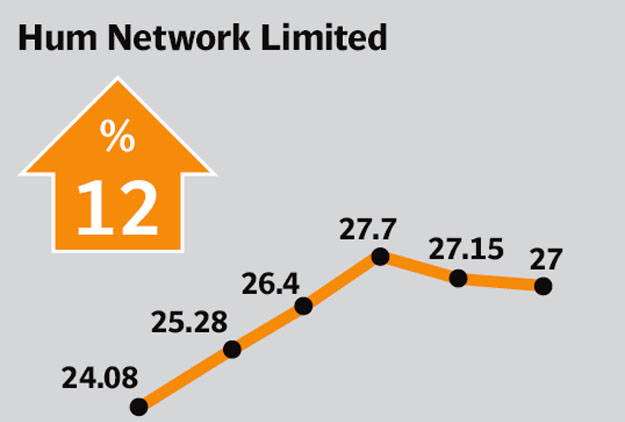

Hum Network Limited

Hum Network operates satellite television channels. The Company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

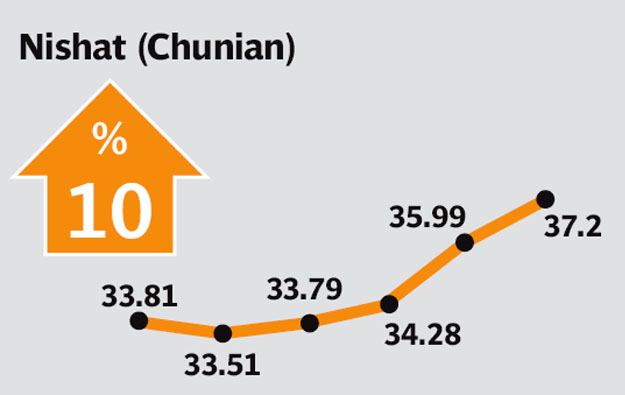

Nishat (Chunian)

Nishat Chunian Limited (NCL), since its inception in 1990 as a single spinning unit, has expanded into a manufacturing and finishing operation consisting of five spinning units, one weaving unit, one dyeing & finishing unit and one stitching unit. NCL operates with 150,000 spindles with a monthly production capacity of 7.5 million lbs of yarn and 4.0 million yards of greige fabric.

Losers of the week

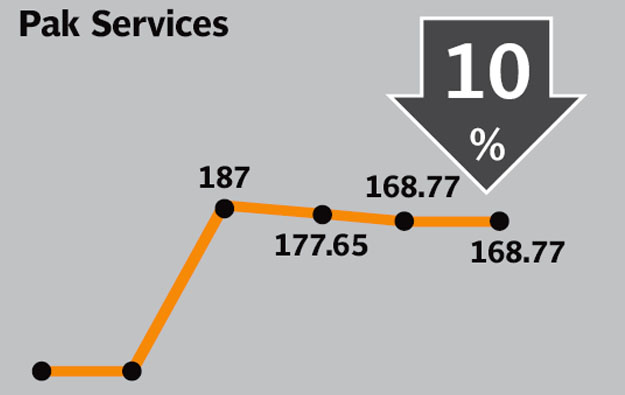

Pak Services

Pakistan Services Limited is primarily engaged in hotel business and owns and operates the chain of Pearl Continental Hotels in Pakistan and Azad Jammu and Kashmir. Its subsidiaries are engaged in rent-a-car, tour packages and project management.

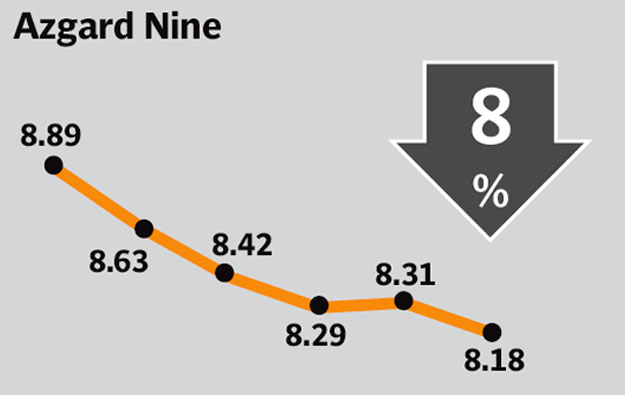

Azgard Nine

Azgard Nine Limited is a vertically integrated, specialised textile company in Pakistan which manufactures yarn and denim garments with a strong customer base in USA, Canada and Europe. It is one of the two denim companies listed on the Karachi Stock Exchange.

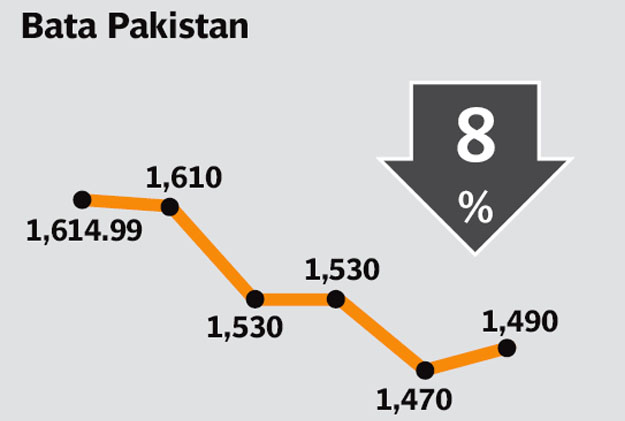

Bata Pakistan

Bata Pakistan Limited manufactures and distributes footwear. It is engaged in the sale of footwear of all kinds along with sale of accessories and hosiery items. Its major brands include Power, Weinbrenner, Marie Claire, Comfit and Bubblegummers.

Published in The Express Tribune, December 16th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ