KARACHI:

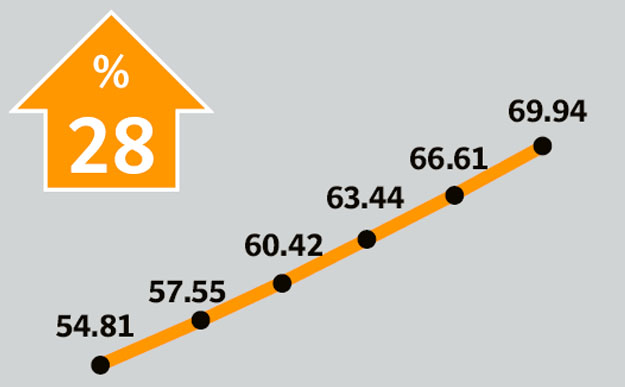

The stock market’s bull run continued relentlessly through the week as positive sentiment prevailed. The benchmark Karachi Stock Exchange (KSE)-100 index soared to a record high of 16,807 points, gaining 234 points (1.4%) during the week ended December 7.

Sector-specific news dominated proceedings at the bourse, coupled with speculations over a discount rate cut in the State Bank of Pakistan’s upcoming monetary policy announcement.

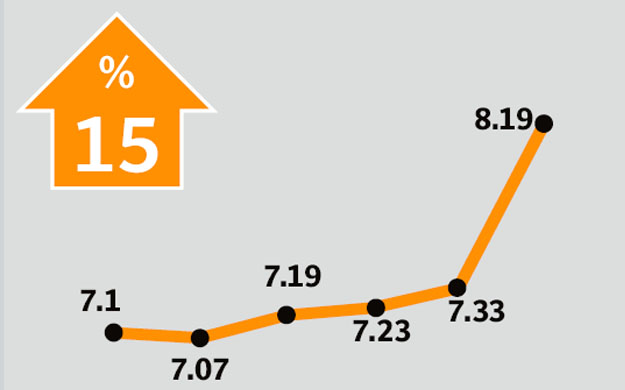

Mixed macroeconomic data also played its role in shaping the market’s direction. The country’s foreign exchange reserves continued to dwindle and fell to $13.5 billion by the end of the week. However, the Consumer Price Index figures for the month of November revealed that inflation dropped to 6.9% during the month on the back of declining food prices and a 35% reduction in CNG prices. As a result, expectations of a discount rate cut were more or less confirmed, and it is now widely expected that the SBP will slash the rate by 50, or even 100, basis points in its upcoming monetary policy announcement.

The discovery of gas at the Suleman-1 field attracted investment in the oil and gas sector, and the Oil and Gas Development Company, Pakistan Petroleum and Pakistan Oilfields all gained during the week.

The banking sector maintained its upwards drive, as news emerged that a cut in the discount rate – if it materialises – will be the last in the foreseeable future. This was coupled with news of lower-than-expected non-performing loan figures for the quarter. MCB Bank witnessed the most gains, climbing 6% during the week.

Lotte Pakistan found itself back in the spotlight on news that the government was going to increase the import duty on PTA from 3% to 5%. The company’s stock closed higher by 15% over last week’s closing.

The cement sector was also in the news, as sales figures for the month of November revealed year-on-year growth of 17.4%, largely in local sales, and moderately in export sales. However, profit-taking was witnessed in cement stocks and the sector ended the week underperforming the market.

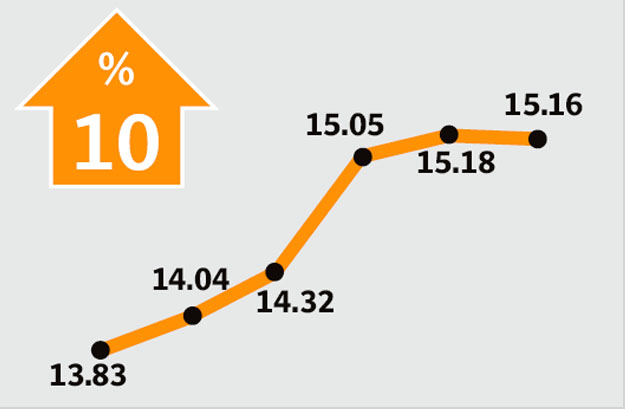

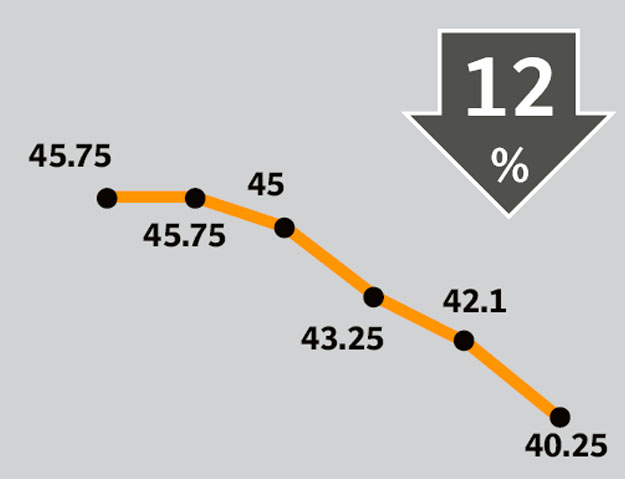

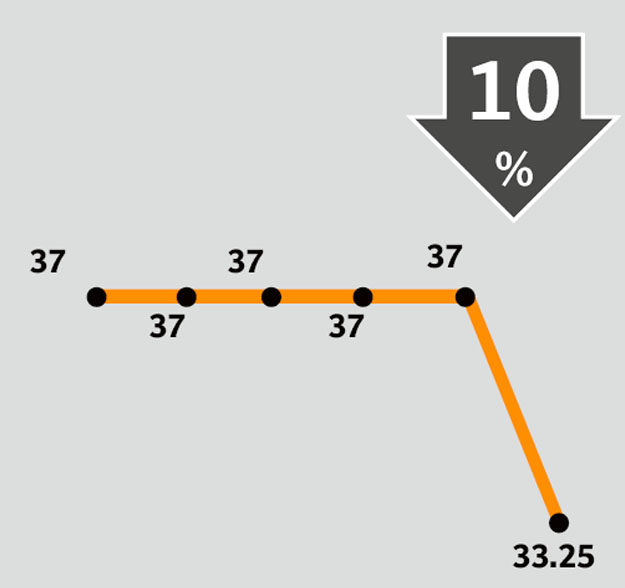

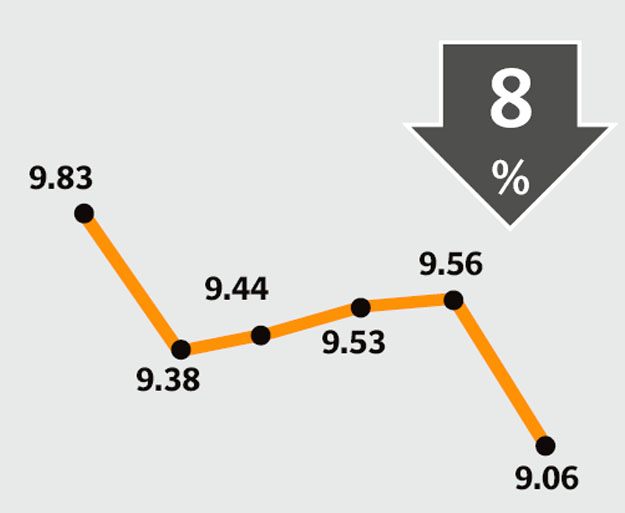

Average daily volumes declined by 18% during the week, but still stood at a healthy 239 million shares traded per day. Average daily values were lower by 8% at Rs. 5.82 billion, as most of the activity remained restricted to second- and third-tier stocks. The market capitalisation of the KSE rose 1.6% to Rs. 4.22 trillion by the end of the week.

The KSE-100 index has appreciated 48% in 2012 and has been one of the best performing markets in the region for the year. Despite the country’s issues with terrorism and law and order, the corporate sector has witnessed record growth and profitability.

Winners of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is primarily engaged in manufacturing sporting goods including hockey sticks. It has a cricket ball manufacturing unit which produces balls with famous brand names like Duke & Sons and Gray-Nicolls.

Lotte Pakistan PTA

Lotte Pakistan PTA is engaged in the manufacture and sale of pure terephthalic acid (PTA), a white powder used in the textile industry as raw material for making polyester fibres. Lotte Pakistan PTA exports PTA to customers in both Asia and Europe.

PICIC Growth Fund

PICIC Growth Fund is a closed end scheme whose principal business is to invest in listed equity securities with an objective to generate capital growth. The fund is managed by PICIC Asset Management Company Limited.

Losers of the week

Shifa International Hospitals

Principal activity of Shifa International Hospitals is to establish and run medical centres and hospitals. The hospital was conceived and incorporated in 1985 by a small group of Pakistani doctors and other healthcare professionals working in the United States.

Feroze 1888 Mills

Feroze 1888 Mills Limited manufactures and sells a wide range of cotton towels and fabrics.

Bankislami Pakistan

Bankislami Pakistan attracts deposits and offers Islamic banking services. The bank offers mortgage and automobile loans, lease financing, wealth management services, and letters of credit and guarantee.

Published in The Express Tribune, December 9th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ