KARACHI: The bourse stepped into fiscal 2012-13 in style, rallying significantly to close above the 14,100 points mark for the first time in six weeks. The stock market closed positive on global optimism after European authorities agreed to shore up the region’s banks.

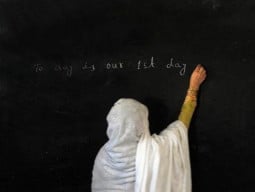

The Karachi Stock Exchange’s (KSE) benchmark 100-share index surged 2.47% or 341.51 points to end at the 14,142.92 points level. Monday was the first day since Mar 16, 2009, that the index added more than 300 points in inter-day trading. Trade volumes improved considerably to 106 million shares, compared with Friday’s tally of 74 million shares. The value of shares traded during the day was Rs4.94 billion.

“The KSE-100 index started the week positively, as news flows from Europe led to recoveries in international commodity and equity markets. Oil stocks were major gainers of the day, as crude moved up 9% in 24 hours. The market saw a broad-based rally as investors are expecting resumption of Nato supplies, which shall lead to disbursement of the Coalition Support Fund,” commented Shakir Padela, analyst at JS Global.

“[The] Oil and Gas Development Company alone contributed more than 100 points [to the index],” added Samar Iqbal, equity dealer at Topline Securities.

Shares of 335 companies were traded on Monday. At the end of the day 176 stocks closed higher, 78 declined while 81 remained unchanged.

Fauji Fertilizer (FFC) was the volume leader with 13.44 million shares gaining Rs2.89 to finish at Rs113.94. It was followed by Jahangir Siddiqui Company with 9.65 million shares gaining Rs1.00 to close at Rs13.41 and DG Khan Cement with 8.50 million shares gaining Rs1.90 to close at Rs41.28.

“FFC closed the day up 2.6%, after clarification on the Gas Infrastructure Development Cess on feedstock for fertiliser producers, and better payout expectations for this quarter,” explained Padela.

Foreign institutional investors were net buyers of Rs602.47 million or $6.34 million, according to data maintained by the National Clearing Company of Pakistan Limited.

“Incorporation of various incentives approved in the budget for betterment of equity markets has indeed provided a conducive environment for local equities to perform at their potential,” commented stock analyst Hasnain Asghar Ali on the day’s proceedings.

Published in The Express Tribune, July 3rd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ