According to the first quarterly report on the state of Pakistan’s economy released by the SBP on Friday, a strong growth in sugarcane and maize production, improved output of cotton and better supplies of minor crops suggest some recovery in agricultural growth.

SBP's annual report shows 4.1% growth rate

Acknowledging subdued performance by the large-scale manufacturing (LSM) sector in the first quarter (Jul-Sept) of 2016-17, the central bank expected that growth would gain some pace going forward on the back of supporting policies and encouraging outlook for automobile, sugar, pharmaceutical and construction-related sectors.

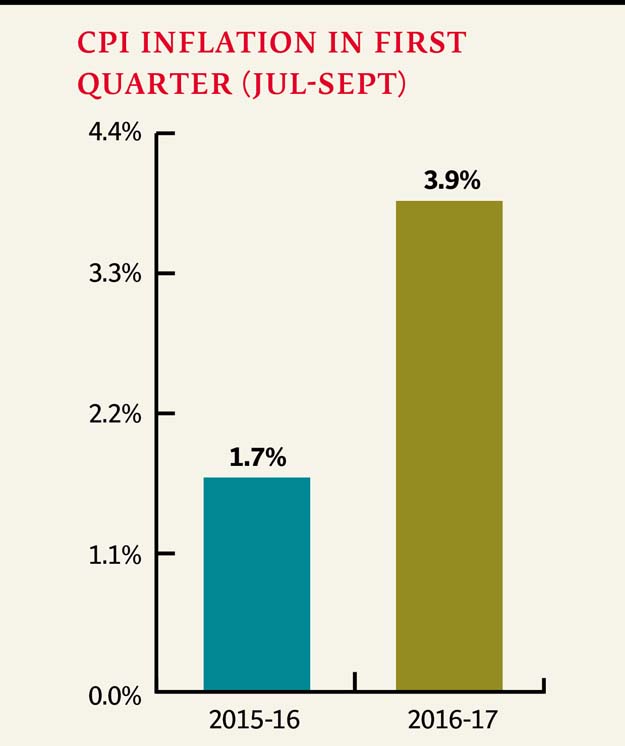

The report also noted that average headline Consumer Price Index (CPI) inflation had increased from 1.7% in the first quarter of 2015-16 to 3.9% in the first quarter of 2016-17.

The increase was expected as inflation had already dipped to ultra-low levels last year and a further push came from supply-side factors including a gradual rise in international prices of some key commodities.

For the full year, the CPI inflation was expected to remain within the target of 6%, the report said.

According to the report, large retirement of private-sector credit in the first quarter of FY17 was commensurate with the extraordinary off-take in June 2016. Moreover, a few large corporates remained shy of borrowing despite the historic low interest rates.

A positive development, however, was the higher loan demand for fixed investments, particularly for energy-related capital expenditures.

The report highlighted the increase in fiscal and current account deficits in the quarter under review and pointed out that the year-on-year increase was driven primarily by the absence of inflows under the Coalition Support Fund.

In the case of current account, additional pressure came from a widening trade deficit (with rising imports and declining exports) and a fall in worker remittances - the first such decline in the past 14 quarters.

State Bank maintains target rate at 5.75 per cent

On the fiscal side, the report noted that decline in non-tax revenues and lower-than-expected tax collection contributed towards the rise in deficit in the first quarter. However, it appreciated the marginal decline in current expenditures following reduction in subsidies by the government.

Interest payments remained unchanged as the gains realised from low interest rates were largely offset by the accumulation of public debt stock.

Moreover, the report viewed positively the increase of 12.4% year-on-year in development expenditures, especially by provinces that scaled up their infrastructure spending during the quarter.

Finally, the report outlined the role of private businesses for higher growth.

Published in The Express Tribune, December 31st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713853507-0/MalalaHilary-(2)1713853507-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ