KARACHI: Political uncertainty regarding the Panama case hearing and aggressive selling by foreign investors took toll on the stock market, with the benchmark-100 index recording a second successive session in the red.

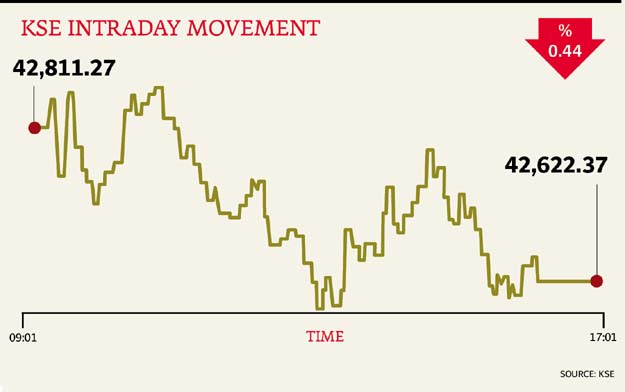

At close on Wednesday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index fell 0.44% or 188.9 points to finish at 42,622.37.

Elixir Securities analyst Faisal Bilwani said Pakistan equities closed negative primarily on reports/rumors of aggressive across-the-board foreign selling.

“Market traded lackluster in the morning as investors awaited developments on court hearing of PM family’s case, however, activity picked up and most stocks attempted to recover following court’s decision to hear again next week,” said Bilwani. “This bounce proved to be short lived as investors were spooked by reports of aggressive foreign selling that wiped any hopes of recovery during the day.”

Bilwani added that oil saw interest as global crude recovered but index heavy exploration and production ended the day in red as local buying reportedly was out matched by supply from foreign institutional sellers.

JS Global analyst Nabeel Haroon said pressure was witnessed as the index shed around 189 points to close at 42,622 level. “Textile sector continued its downward trajectory to close (-0.8%) lower from its previous day close on the back of All Pakistan textile Mill Association’s call to shut down mills by December 6.

“Pakistan Petroleum Limited (-1.7%) and Oil and Gas Development Corporation (-0.7%) in the E&P lost value to close in the red zone, as sceptical investors preferred to be on the sidelines fearing continuous foreign selling.”

Trade volumes fell to 394 million shares compared with Tuesday’s tally of 585 million.

Shares of 414 companies were traded. At the end of the day, 153 stocks closed higher, 246 declined while 15 remained unchanged. The value of shares traded during the day was Rs13.6 billion.

Bank of Punjab was the volume leader with 37.2 million shares, losing 0.01 to finish at Rs19.51. It was followed by Pace (Pak) Limited with 24.2 million shares, gaining Rs0.38 to close at Rs13.16 and Aisha Steel Mills with 22.3 million shares, gaining Rs0.10 to close at Rs14.93.

Foreign institutional investors were net sellers of Rs1.17 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 1st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ