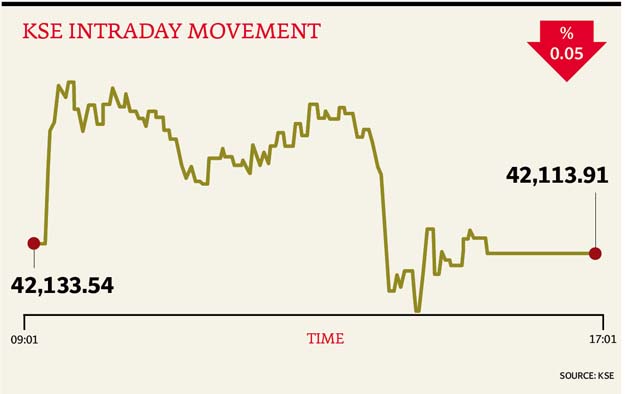

The earlier half of the day saw the KSE-100 reach a new record high, moving past the 42,400-point mark, but profit-taking by a few foreign investors ahead of the US elections pushed the index in the red.

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a fall of 0.05% or 19.63 points to finish at 42,113.91.

Elixir Securities, in its report, stated that the wider market carried positive momentum from Monday and opened gap up on good volumes as investors took cues from higher global equity markets and relative political calmness on domestic front.

“Cements gained traction over release of higher monthly local sales number and approval of key local infrastructure projects and led early gains, while notable blue chip names and sideboard plays also supported the upward ride,” said analyst Ali Raza.

“However, late profit taking, reportedly by few foreign sellers, resulted in the KSE-100 shedding all gains with index heavy financials - Habib Bank (HBL PA -1.03%), United Bank Limited (UBL PA -1.33%) - and select Index names -Lucky Cement (LUCK PA -1.1%), Hub Power (HUBC PA -0.9%) - bearing the brunt of selling pressure,” said Raza.

“We expect volatility to prevail with investors trading cautiously and bracing themselves for market jolts as key outcome of US presidential election is due in early hours (on Wednesday),” he added.

Meanwhile, JS Global analyst Nabeel Haroon was of the view that market opened on a positive note and rallied to make an intraday high of 280 points but came under selling pressure during the last hours of the trading session.

“Investor interest was seen in the cement sector on the back of numbers released by APCMA that showed YoY growth of 12.87% in the cement dispatches for the month of October-2016,” the analyst remarked.

“FCCL (4.86%) and CHCC (2.97%) were top performers of the aforementioned sector.

“FFBL in the fertiliser sector continued to garner investor interest as it gained to close on its upper circuit. This gain was on the back of EOGM announcement by the company yesterday in which a resolution to acquire FFBL Power Company Limited (FPCL) was announced,” said Haroon.

“A coal based power plant of 110MW is being set up under FPCL, this coal based power plant will have a significant contribution to the company’s bottom line going forward,” he added.

Trading volumes rose to 480 million shares compared with Monday’s tally of 333 million.

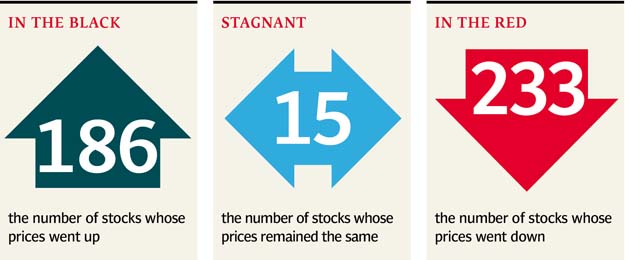

Shares of 434 companies were traded. At the end of the day, 186 stocks closed higher, 233 declined while 15 remained unchanged. The value of shares traded during the day was Rs20.3 billion.

The Bank of Punjab was the volume leader with 57.2 million shares, gaining Rs0.19 to finish at Rs19.52. It was followed by K-Electric Limited with 31.5 million shares, losing Rs0.02 to close at Rs9.29 and Pakistan International Bulk Terminal with 29.5 million shares, gaining Rs1.49 to close at Rs33.00.

Foreign institutional investors were net sellers of Rs879 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 9th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1713853507-0/MalalaHilary-(2)1713853507-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ