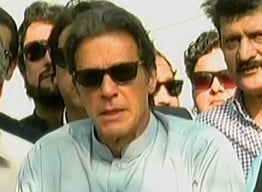

KARACHI: The Imran Khan show hasn’t even begun and over $3.35 billion have been wiped off Pakistan’s stock market.

Jittery over PTI’s planned protests in Islamabad and the party’s history of being able to bring the federal capital to a standstill, investors have pulled out money this past week, stopping an advance that saw the KSE-100 Index - a benchmark for market performance - gain 26.6% in less than 10 months alone. The push to sell increased even more once Tahirul Qadri announced his decision to join PTI’s protest.

No one will be allowed to shut down Islamabad on Nov 2, IHC tells authorities

Since hitting its record high on October 20, 2016, the benchmark-100 index has retreated 1,558.64 points, down 3.75% during the course of five trading sessions that wiped off over Rs353.65 billion.

Thursday was no different story.

By the close of trading, the Pakistan Stock Exchange’s benchmark KSE 100-share Index had declined 1.3% or 539.50 points to end at 39,987.31.

Muhammad Shamoon Tariq, partner and portfolio manager at Sweden-based Tundra Fonder that has assets under management in Pakistan worth $150 million, said political uncertainty has taken its toll. “Increasing political uncertainty, as date of PTI protests in Islamabad approaches, remains the main reason of nervousness among investors,” said Tariq in an emailed response to The Express Tribune. “The situation is exacerbated with religious parties joining the protest.

“Absence of triggers is also keeping investors away from picking up asset at lower levels,” added Tariq, referring to the absence of support at attractive and discounted valuations.

Imran led a similar protest in the latter half of 2014, shutting down the federal capital’s Red Zone for four months. Back then, the market reacted in a different way. After taking the cricketer-turned-politician’s plans seriously for a few days and adopting caution, investors were quick to shrug off effects of the ‘Dharna’ as the benchmark-100 index increased by over 14% during the August-December period.

However, this time investors are sceptical. Tariq says the timing has coincided with a few other crucial developments on the political front. “Markets are always scared of uncertainty and in the current protest call of PTI, no one is very sure of the outcome. The timing of these protests is also significant as the new Army chief’s appointment is still pending.

Pakistan's economic outlook at six-year high

“Political noise always has a greater impact on equities than any other news flow. The locking down of the capital where all the government machinery, foreign diplomats and foreign institutions reside is certainly the most important factor in the investors’ minds right now.”

Imran’s attempt to compel Prime Minister Nawaz Sharif to present himself for accountability has also eaten away at the bullish run that saw the KSE-100 Index gain close to 27% since January.

The PSX, Asia’s best-performing market according to a basket of 26 peers tracked by Bloomberg, was given a boost in June this year when MSCI announced its decision to reclassify Pakistan to its Emerging Markets Index.

That run, however, has now been overshadowed by political uncertainty.

“The market is likely to take cue from the developments in Islamabad and how the protesting crowd is handled. If situation is resolved amicably, we think the market should bounce back but any adventurous move by any party can result in prolonged correction in the market,” said Tariq, admitting that the short-term view in the market remains weak.

On Thursday, trade volumes rose to 384 million shares compared with Wednesday’s tally of 347 million.

Will outstanding warrants spoil the dharna?

Shares of 440 companies were traded. At the end of the day, only 54 stocks closed higher, 373 declined while 13 remained unchanged. The value of shares traded during the day was Rs12.4 billion.

Bank of Punjab was the volume leader with 41.6 million shares, losing Rs0.93 to finish at Rs16.33. It was followed by NIB Bank Limited with 23.5 million shares, gaining Rs0.07 to close at Rs2.03 and TRG Pakistan with 22.2 million shares, losing Rs2.15 to close at Rs40.90. Foreign institutional investors were net buyers of Rs913 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 28th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (11)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ