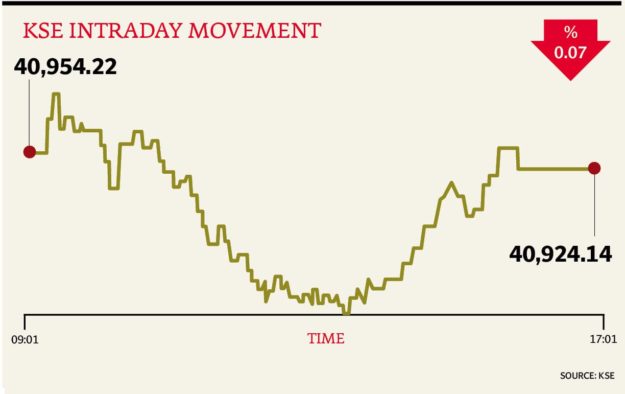

After a positive start that saw the KSE-100 - the benchmark for market performance - open 100 points up, stocks endured wild swings and lost ground for the subsequent four hours.

Profit-booking kicked in soon enough, taking the index as down as 40,700 before investors value-hunted to take stocks higher.

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index ended with a fall of 0.07% or 30.08 points to end at 40,924.14

Elixir Securities, in its report, stated Pakistan equities settled marginally lower as late value buying in select blue chips and sideboards helped trim the morning losses.

“Mid-day recovery came as investors cheered release of better earnings by notable companies and resultantly benchmark KSE-100 index rebounded after testing 40,700,” said analyst Ali Raza.

“United Bank Limited (UBL +1.9%) emerged as the top mover after it announced earnings higher than consensus, while Attock Petroleum (APL +3.6%) also hit upper price limit intra-day after posting stellar quarterly earnings,” Raza remarked.

“Select cements also aided to recovery with Maple Leaf Cement (+1.0%) and DG Khan Cement (DGKC +0.4%) finding interest at lows as rumours did rounds of a possible increase in cement prices in the coming days.

“Meanwhile, Hub Power (HUBC -2.4%) again proved a laggard and dented KSE-100 index the most after the company yesterday hinted at the possibility of scaling back on its expansion project,” he added.

Meanwhile, JS Global was of the view that volatility prevailed in the market as the index traded between an intraday high of +111 points and intraday low of -285 points to finally close on a flat note (-0.07%).

“HUBC (-2.36%) lost value for the second consecutive day on the back of announcement by the company that its joint venture company China Power Hub Generation Company (CPHGC), which is undertaking 2x660 MW coal based power plant, is in discussion with the Government of Pakistan over improvement in Required Commercial Operation Date (RCOD),” said analyst Nabeel Haroon.

“In case of unfavourable outcome of the discussion project size could potentially be reduced to 1x660MW coal based power plant. FRSM (0.64%) gained on the back of the news that the company has planned to establish a food company by the name of ‘Uni-Food Industries Limited’ with an initial investment of Rs280m,” said Haroon.

“In the refinery sector NRL (-3.06%) and ATRL (-1.34%) were major losers, as both companies declared their result for 1QFY17, which were lower than the street estimates. Moving forward we advise investors to adopt a cautious approach in the market,” he added.

Trading volumes rose to 506 million shares compared with Tuesday’s tally of 383 million.

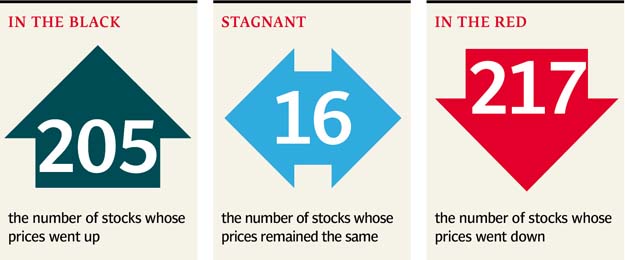

Shares of 438 companies were traded. At the end of the day, 205 stocks closed higher, 217 declined while 16 remained unchanged. The value of shares traded during the day was Rs12.5 billion.

Dost Steel (R) was the volume leader with 136 million shares, losing Rs0.09 to finish at Rs3.91. It was followed by Bank of Punjab with 65.5 million shares, gaining Rs0.95 to close at Rs17.45 and Aisha Steel Mill with 25 million shares, losing Rs0.52 to close at Rs13.46.

Foreign institutional investors were net sellers of Rs304 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 19th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ