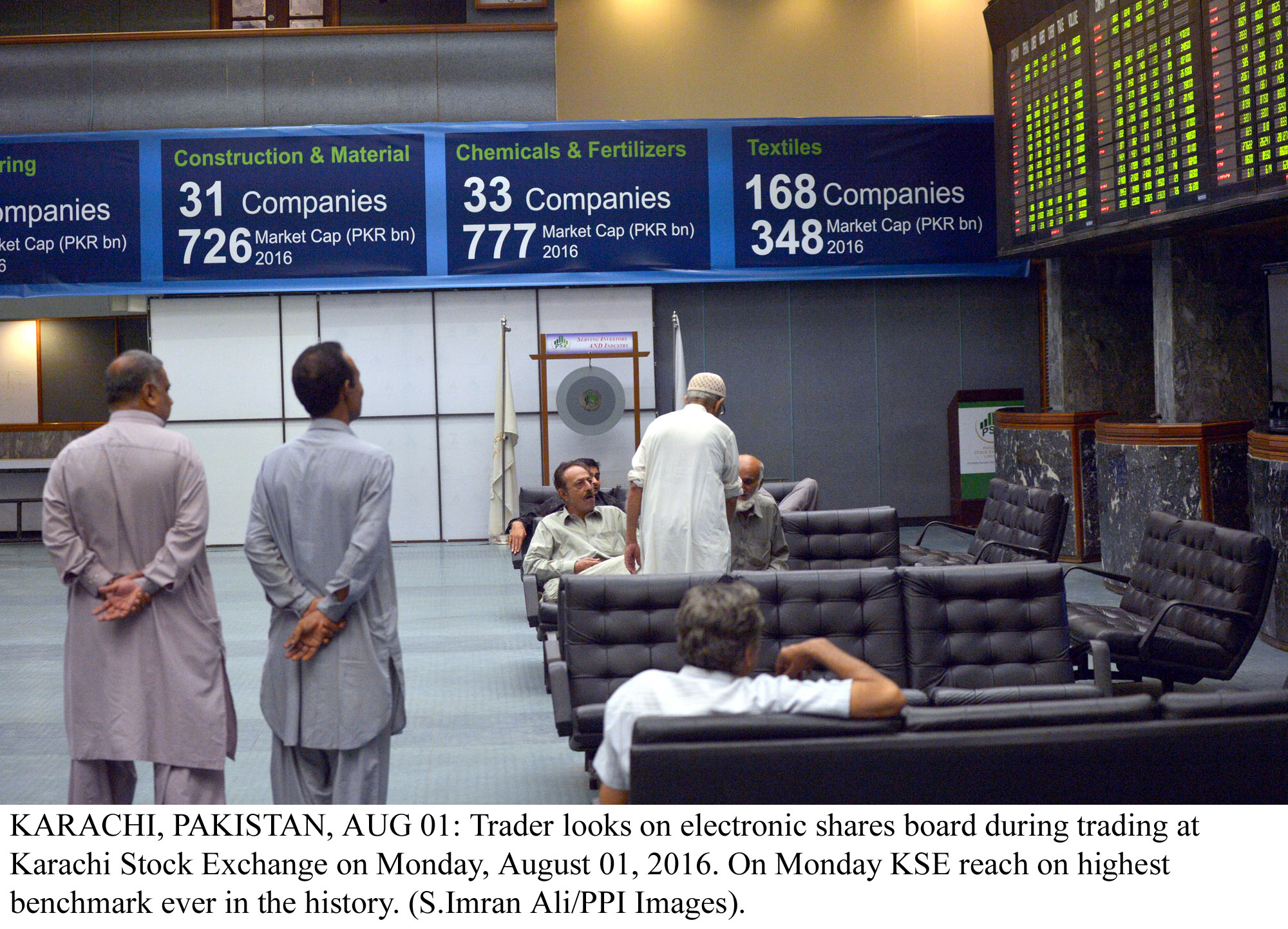

KARACHI: The benchmark-100 index powered past the 41,000-point barrier, a level that had eluded it for so long, for the first time as investors kept taking an interest in financials and select industrial stocks.

At close on Tuesday, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a rise of 0.34% or 137.66 points to end at its highest ever close of 41,123.97.

Elixir Securities, in its report, said the market opened positive but traded lacklustre for a brief period as participants, mainly institutional investors, remained selective in early trade.

“As the day progressed, financials fetched interest from institutions with all top-tier names United Bank (UBL +1.48%), MCB (MCB PA +1.37%) and Habib Bank (HBL PA +0.7%), trading higher and contributing to index gains while the Bank of Punjab (BOP PA +7.1%) was up on reported local retail and prop-book buying.

“Cements, on the other hand, failed to carry momentum and succumbed to selling pressure on reported institutional profit-taking with DG Khan Cements (DGKC PA -1.4%) denting KSE-100 index the most,” said the report.

“Overall, second- and third-tier stocks generated most activity as retail investors continued to participate aggressively with many speculative plays eking out handsome gains.

“We see volatility to prevail with flows mainly guiding the market direction while profit-taking in select sectors such as financials may likely kick in ahead of the weekend,” commented Elixir Securities analyst Ali Raza.

Meanwhile, JS Global analyst Nabeel Haroon said profit taking was witnessed in cement sector on the back of news that House Building Finance Company Limited (HBFCL) has suspended loan facility for new applicants putting a number of residential housing projects at risk.

“DGKC (-1.39%) and FCCL (-1.93%) were major losers of the aforementioned sector.

“News that government might allow export of additional 0.35 million tons of sugar as there might be a surplus stock on harvest of this year’s crop developed investor interest in the Sugar and Allied Industries sector.”

“Habib Sugar Mills Limited (HABSM) and Faran Sugar Mills Limited (FRSM) were top performers of the aforementioned sector, as they gained to close on their respective upper circuits.”

“Nishat Chunian Limited (NCL +1.79%) gained as investors anticipated that textile manufacturer will post growth in its bottom line in its FY16 result, which will be announced on Wednesday.

“Moving forward, we reiterate our bullish stance on the market and advise investors to accumulate on dips,” said Haroon.

Trade volumes fell to 559 million shares compared with Monday’s tally of 568 million.

Shares of 450 companies were traded. At the end of the day, 245 stocks closed higher, 190 declined while 15 remained unchanged. The value of shares traded during the day was Rs17.3 billion.

The Bank of Punjab (BoP) was the volume leader with 59.1 million shares, gaining Rs1 to finish at Rs15.10. It was followed by Pakistan International Airlines (P.I.A.C) with 44.1 million shares, gaining Rs0.72 to close at Rs9.55 and TRG Pakistan Limited with 32 million shares, gaining Rs1.43 to close at Rs47.34.

Foreign institutional investors were net sellers of Rs1 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 5th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ