KARACHI: Rising tension between Pakistan and India took its toll on the stock market as the benchmark-100 index plunged 1.41% Wednesday, wiping off most gains made in the previous few trading sessions.

Concerns over domestic politics as well as uncertainty over the future of Pakistan-India relations were enough to make investors jittery, who took little time to decide on an exit.

Sabre-rattling aside, India unlikely to go for military adventure

Stocks fell soon after the opening bell and the KSE-100 Index slid below 40,000, bringing an end to gains in speculative plays and penny stocks.

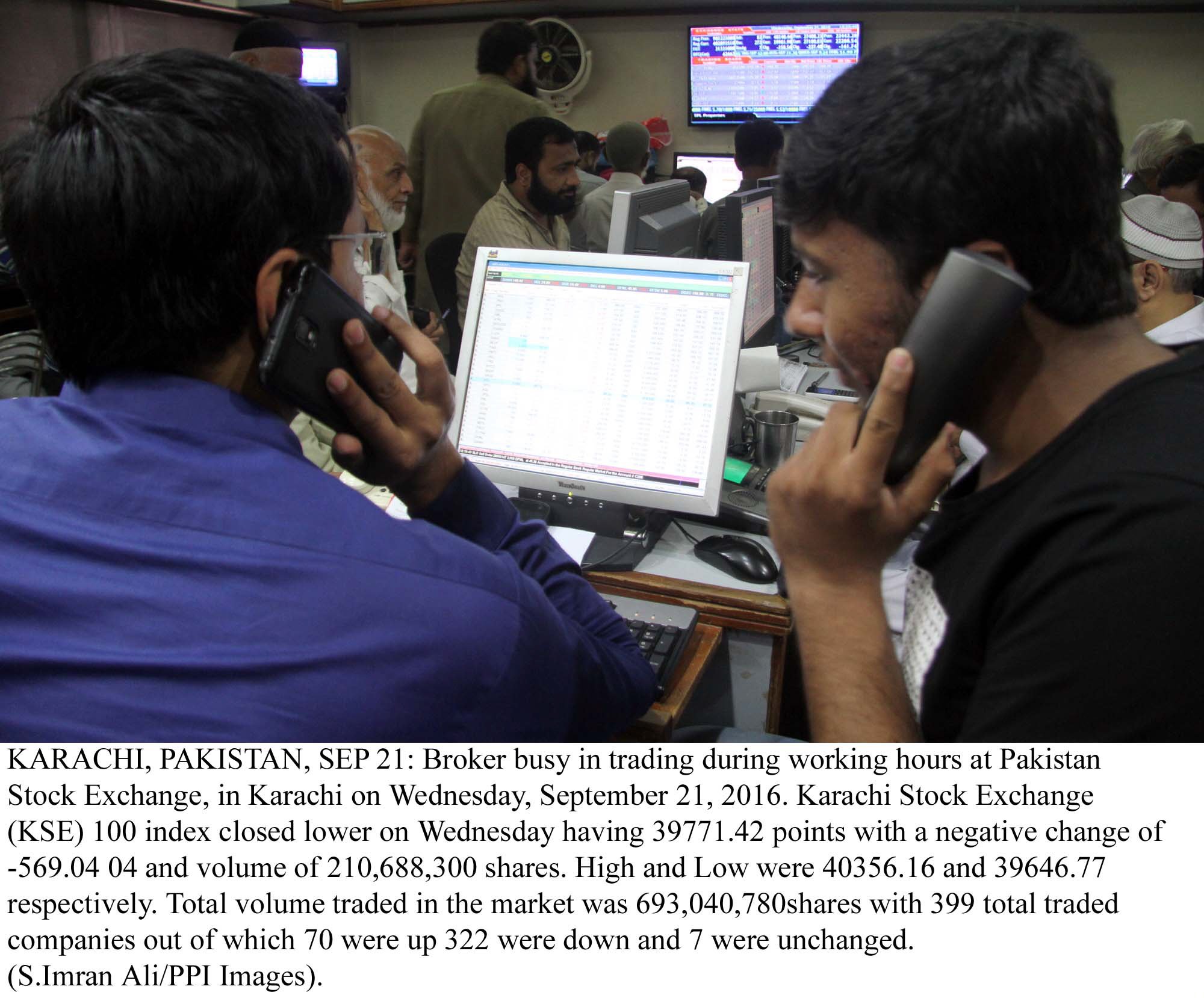

At close, the Pakistan Stock Exchange’s benchmark KSE-100 index finished 1.41% or 569.04 points lower to end at 39,771.42.

Elixir Securities, in its report, stated concerns over domestic politics and, more importantly, geo-politics after the recent Kashmir attack spooked investors and gave equities a good excuse to correct.

“After the morning bell, market soon slipped lower followed by mid-day recovery, however, reports of foreign selling in index names and retail investors’ struggle to offload small and mid-caps pulled benchmark to close the day with worst losses in last twelve weeks,” said analyst Faisal Bilwani.

Meanwhile, JS Global analyst Ahmed Saeed Khan was of the view that third tier stocks led the decline as retail investors caved in to rampant margin calls.

India summons Pakistani envoy over Uri attack

“The fertiliser sector continued to remain under pressure as the government failed to announce the subsidy payment scheme on imported DAP,” said Khan.

“Major index movers of the aforementioned sector today were FFC (-1.75%) and ENGRO (-0.96%).

“The oil sector remained under pressure despite global crude oil price rising as concerns grew that OPEC will not clinch a deal to limit oil production in Algiers next week as members stay focused on either boosting output or defending their market share, major losers of the day in the oil sector were OGDC (-0.59%) and PPL (-0.42%),” he added.

Trade volumes fell to 693 million shares compared with Tuesday’s tally of 903 million.

Shares of 441 companies were traded. At the end of the day, 73 stocks closed higher, 362 declined while 6 remained unchanged. The value of shares traded during the day was Rs19 billion.

MSCI reclassification: Has the stock exchange become more vulnerable?

WorldCall Telecom was the volume leader with 63.4 million shares, losing Rs0.27 to finish at Rs2.35. It was followed by Pace (Pak) with 55.2 million shares, losing Rs0.11 to close at Rs10.01 and Bank of Punjab with 50.2 million shares, losing Rs0.88 to close at Rs11.26.

Foreign institutional investors were net sellers of Rs123 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 22nd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ