LAHORE: As part of the provincial budget announcement, the Punjab government on Monday declared that it would be increasing tax revenues to Rs184.43 billion in fiscal year 2016-17 with the addition of two more services to the tax net.

However, the province is expected to fall short of current year’s tax collection target as a majority of new services are reluctant to pay taxes. Initially, the target was Rs160.59 billion, but because of a slow growth in collections, it was revised downwards to Rs150.79 billion.

Punjab presents Rs1.681 trillion budget for fiscal year 2016-17

Non-tax revenues are expected to be Rs95.62 billion. In Punjab, 59 sectors had been identified and brought under the tax net and by adding two other services (cosmetic surgery/hair transplant and warehouse/cold storages), the number will reach 61 sectors.

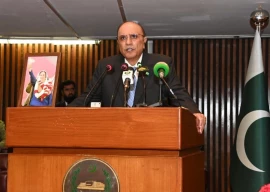

The province largely depends on the federal divisible pool to meet its expenses and Punjab Finance Minister Dr Ayesha Ghaus Pasha expects to receive Rs1.010 trillion from Islamabad in the next fiscal year, which is almost 16% higher than current year’s federal transfers.

“The government will continue to struggle for many years in terms of tax collection as it has been unable to create a mechanism to add agriculture to the tax net,” said former finance minister Dr Salman Shah.

Pakistan Tehreek-e-Insaf leader Dr Murad Shah said the government could not impose taxes on the people like the way it was currently doing.

“People will find loopholes when the government slaps a tax. We compare ourselves with European countries but we lack an effective tax mechanism,” he added.

Tax revisions

Apart from adding two new services to the tax net, many other taxes have either been imposed or increased by the provincial government.

For example, it slapped a one-time tax on imported vehicles of above 1,300cc engine capacity and a tax on vacant plots.

The tax on vacant plots is introduced to check speculative real estate trade and improve supply of housing units by discouraging retention of vacant plots for long periods of time and to strengthen the local government tax base.

The tax on vacant plots will be levied after two years of taking possession by the owner. Moreover, the provision relating to exemption of building and land used exclusively for educational purposes should be clarified by adding an explanation.

Pakistan Business Council presents detailed critique of new budget

Additionally, the government has imposed a professional tax of Rs5,000 on medical consultants, specialists and dental surgeons.

The rate of tax will be different for various categories of motor cars - vehicles with engine capacity exceeding 1,300cc but not exceeding 1,500cc will be subject to a tax of Rs70,000. Cars with engine capacity exceeding 1,500cc but not exceeding 2,000cc will be charged Rs150,000.

Cars with engine capacity exceeding 2,000cc but not exceeding 2,500cc will be charged Rs200,000 in tax and motor cars with engine capacity exceeding 2,500cc will be charged Rs300,000.

The government has also proposed the rationalisation of registration fee of vehicles and to streamline the system for the taxpayers it has proposed lump-sum and periodic payments.

In order to safeguard public revenues, it is proposed that Article 63A of Schedule-I of the Stamp Act 1899, which is meant for transfer of a right or interest relating to an immovable property, may be inserted in Section 27A of the Act so that the assessment of the land may be made according to the valuation table.

Currently, stamp duty at the rate of 3% is being charged on the value of immovable property in case of transfer of a right or interest in the housing sector. However, the valuation tables notified by the District Collector under Section 27A are not applicable to such transfers.

Services tax

The operational experience gained by the Punjab Revenue Authority during the preceding financial year has led to the proposal of some technical amendments to the Punjab Sales Tax on Services Act 2012.

The technical amendments are related to encouraging the use of banking channels, input tax credit rationalisation and penalties for the non-compliant taxpayers.

Punjab to get three special economic zones

In order to iron out compliance gaps arising out of diversities of the services tax tariff interpretations, descriptions of a few taxable services have been made consistent with their definition provided in the relevant rules so that any ambiguity is removed and taxpayers have clear understanding of their tax obligations.

Published in The Express Tribune, June 14th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ